Contrary to popular perception among Nigerians that Nigeria’s N103 trillion debt is owed by the federal government only, Lagos, Delta and Ogun, Rivers, Akwa Ibom, Cross River, Bayelsa and a few others are highly indebted and contribute in no small amount to Nigeria’s debt burden.

As the NNPC Limited has failed to remit to the federal government to fund the FAAC, states have resorted to borrowing more to fund their operations. Hence, states’ debt have increased in recent months.

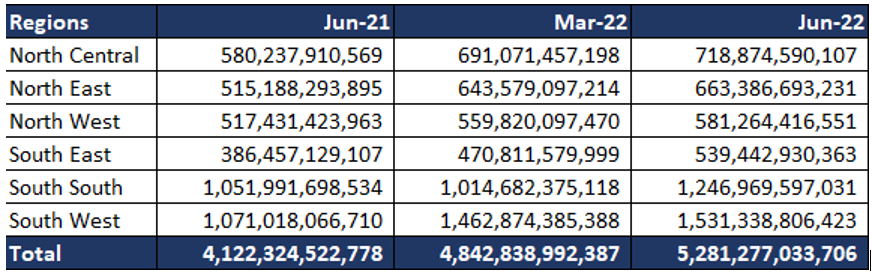

According to the Debt Management Office (DMO), many states have borrowed more between the first and second quarters of the year 2022. In March, the 36 States and the Federal Capital Territory had a domestic debt of N4,842,838,992,386.22. However, this has risen to N5,281,277,033,703.91 as at the end of June.

As of the time under review, Lagos State borrowed a total of N797,305,312,602.53. This shows that the debt profile of Lagos has increased from the N780,476,880,563.06 it was in March 31, 2022.

Also, the debt stock of Delta State skyrocketed within the three months period. From N163,478,454,259.54 in March this year, Governor Ifeanyi Okowa’s administration has increased the domestic debt of Delta to N378,878,236,830.76. That is more than 100 percent increase from March to June this year.

Ogun on the other hand is owing a total of N241,782,021,304.96. Though it stands among the top three most indebted States, Ogun debt figure has marginally reduced from the N241,979,216,147.55 it was in March.

A document released by the Debt Management Office indicates that Rivers is the fourth with a debt stock of N225,505,011,356.55.

Imo State, with a domestic debt of N210,394,836,519.93, is the fifth. The State has borrowed more as the DMO report shows that the debt figure of Imo was N204,612,397,430.39 in March.

Akwa Ibom is sixth on the list, having borrowed a total of N203,951,611,822.07. This is a slight increase from the N203,112,373,546.77 it had in the first quarter of the year.

It was gathered that Cross River has a debt profile of N176,086,197,586; Oyo has borrowed N159,906,877,910; Osun and Bayelsa are owing N150billion each, while Plateau and Benue State owe N144.60billion and N143.54billion, respectively, as of the time under review.

In the same vein, Bauchi has borrowed up to N129billion; Kano, N125 billion; Gombe, N123.6billion; Adamawa, N120.6billion; Ekiti, N119.5billion; Zamfara, N115.7billion; Edo, N112.1billion; Kwara, N110.5billion; Abia, N107.6billion and Borno, N102.4billion.

Also, Yobe State has over N96.6billion as its domestic debt profile; Taraba, N90.8billion; Kogi has N90.5billion; Sokoto has N89.9billion; Enugu, N89.9billion; Niger, N80.9billion; Kaduna, N78.1billion; FCT has N75.7billion; Nasarawa, N72.9billion and Anambra, N72.4billion.

Jigawa is the state with the lowest debt profile having borrowed a sum of N45,135,377,621.30. However, the debt profile of Jigawa also rose with over N3billion between March and June 2022. As of March, Jigawa’s domestic debt was N41,629,971,249.71.

Jigawa is followed by Ebonyi with N59.1billion; Kebbi, N60.4billion; Ondo with N62.2billion and Katsina with N66.6billion.

Meanwhile, many Nigerians have continued to seek explanations about the modes of borrowing these loans, the repayment plans and the purpose for which the monies are borrowed.