Ahead of the release of the redesigned naira notes, the Lagos Chamber of Commerce and Industry (LCCI) has urged the Central Bank of Nigeria to consider redesigning the lower denomination notes to coins.

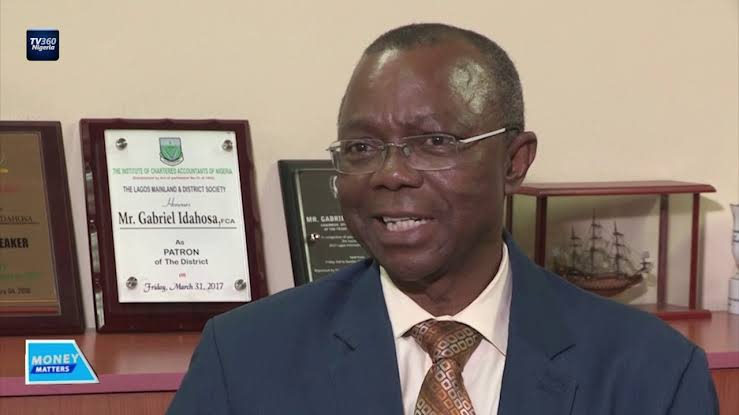

This, the LCCI said, would reduce to cost of printing lower denomination notes of the naira which do not last for long sue to their repetitive use. The deputy president, LCCI, Mr. Gabriel Idahosa, said this while speaking at the CBN special day at the Lagos International Trade Fair.

“We urge the CBN to implement the correct calibration of monetary policy considering the resilience of our economy and the implementation of the global monetary spillover to financial stability.

“As regards issuance of new naira notes, the CBN should also consider converting the country’s lower currency notes into coins to facilitate highly repetitive retail transactions and avoid printing pieces of low-value notes with a short lifespan. We also appeal to the CBN to adopt more innovative ways to establish appropriate policies and take actions that will drive down the inflation rates and strengthen the value of our naira,” he pointed out,

On his part, the CBN director, Corporate Communications department, Osita Nwanisobi, noted that, the apex bank is committed to ensuring the economy is resilient to endure unanticipated shocks.

Nwanisobi, who was represented by the CBN acting director, Corporate Communications department, Mr. Sam Okogbue, said: “the CBN Governor, Mr. Godwin Emefiele, and his team are resolute in steering the ship of Nigeria’s economy to prominence. The focus of the bank is macroeconomic stability which entails building a strong, stable, and resilient economy that is self-sustaining and able to weather unanticipated shocks.

“This, the bank will do, by applying appropriate monetary policy tools, striving to rein in inflation, and continuously encouraging a productive economy through its interventions. We have no other country than Nigeria, and it is our collective responsibility, as Nigerians, to make the country work.”

He added that the various interventions which has yielded a positive impact on the is a testament to its commitment for macroeconomic stability.

“The economy through its various are In addition to this, the bank has initiated interventions that recorded significant successes in providing the needed structure for businesses to grow.

“These include the Micro, Small and Medium Enterprises Development Fund (MSMEDF), which has supported entrepreneurship development with over N39.26 million; the Real Sector Support Facility (RSSF) through Differentiated Cash Reserve Ratio (DCRR), where disbursements to 426 projects across the country stood at A2. 10 trillion as at September 2022; and the 100 for 100 Policy on Production and Productivity (PPP) with cumulative disbursement of N93.39 billion to 62 projects within the aforementioned period.

“Others include the Tertiary Institutions Entrepreneurship Scheme (TIES), which has total disbursement of N332.43 million; the Healthcare Sector Intervention Facility (HSIF) with cumulative disbursement of N130.54 billion for 131 projects, comprising 32 pharmaceuticals, 60 hospitals, and 39 other services.”

He added the Central Bank of Nigeria will continue to demonstrate an unwavering commitment to supporting a productive economy and prudent management of the country’s vast resources as that is the only panacea to reaching Nigeria’s desired economic destination.

He said: “the establishment of the Secured Transactions in Movable Assets Act (National Collateral Registry Act) and the Credit Reporting Act are part of the efforts of the Bank to institutionalize a business- friendly environment where businesses could thrive seamlessly, particularly the Micro, Small and Medium Enterprises (MSMEs), which is the engine of growth in any economy.”