The Shareholders’ Fund of LASACO Assurance Plc rose by 15 per cent to N12.99billion in 2022 from N11.3billion in 2021 financial year.

This is even as the company also declared 15kobo dividend on every share of the company held by shareholders.

Similarly, the Premium Income increased by 4.7 per cent from N13.28billion in 2021 to N13.9trillion in 2022 while it’s Net Premium Income rose from N8,2billion toN9.5billion within the period under review.

While underwriting expenses increased by 9 per cent from N3.5billion in 2021.to N3.8billion in 2022, the company’s Profit before Tax soared from N283million to N1.5billion, translating to 445 percentage growth within the period under review. Hence, Profit After Tax(PAT) increased by 466 per cent from N261million in 2021 to N1.5billion in 2022.

Moreover, its Net Claims Expenses decreased by 14 per cent from N4.4billion in 2021 to N3.7billion in 2022, depicting the ability of the company to minimise risk exposure.

Speaking at the 43rd Annual General Meeting (AGM) of the company in Ikeja, Lagos, yesterday, it’s chairperson, Mrs. Teju Philips, noted that, the firm’s Total Assets grew from N23.96billion to N26.1billion, representing a 8.9 per cent growth rate.

Looking into the future, she promised that LASACO Assurance will maintain and surpassed its current performance through the implementation of best practice policies, digital transformation, process improvement, retail business strengthening, branch network modification and revitalising it’s custoner experience.

While recognising the ever-changing business landscape and as such, remains adaptable and agile in response to new developments and emerging trends, she added that, the goal of the firm is to remain at the forefront of the insurance industry by proactively anticipating and meeting the evolving needs of our customers.

“To achieve this, we are committed to fostering a culture of innovation, collaboration and excellence and we continuously strive to identify and leverage new technologies band tools to drive our growth and enhance our capabilities,” she pointed out.

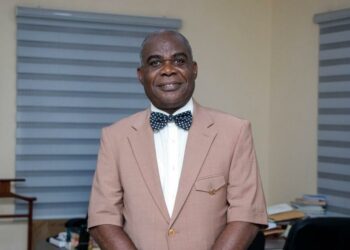

Meanwhile, the managing director of the firm, Mr. Razzaq Abiodun, assured shareholders that the 2023 financial year would be better than the outgoe year as the impact of the new motor insurance policy rate takes effect, thereby, positively increasing premium income from this insurance policy category.