The instability in Nigeria’s forex exchange market and the weakening of the naira present a formidable challenge to the country’s ambitious goal of becoming a $1 trillion economy.

An analysis reveals that the devaluation of the naira has resulted in a significant loss of approximately $193 billion in the country’s gross domestic product (GDP) when converted from naira to dollars.

The analysis spans the year-long period from Q4 2022 to Q3 2023, during which Nigeria accumulated a total GDP of N224.54 trillion. Converted to U.S. dollars using the exchange rate at the end of September 2023 (N768.76/$1), Nigeria’s GDP is approximately $292.08 billion. However, if the pre-FX unification policy exchange rate of about $462.88/$1 is considered, the GDP would have been around $485.09 billion.

The naira’s devaluation of 39.79 per cent has also led to a proportional loss of value in GDP when expressed in dollar terms. Despite a decline in dollar terms, there has been an increase in the quarterly naira value of the country’s GDP, reaching N62.05 trillion in Q3 2023.

While there is growth in naira terms, the currency has experienced a depreciation of up to 40 per cent in 2023 based on official exchange rates, indicating significant currency volatility. Nigeria remains the leading economy in Africa, surpassing South Africa, which is yet to release its Q3 2023 GDP numbers.

Further analysis indicates that for Nigeria’s GDP to fall below South Africa’s when measured in U.S. dollars, the naira would need to decline to approximately N900/$1. However, this analysis considers official exchange rates and assumes they are not artificially fixed.

The federal government’s ambition of achieving a $1 trillion economy by 2026 seems challenging based on the current trajectory. The recently approved Medium-Term Expenditure Framework and Fiscal Strategy Paper (MTEF/FSP) projects a GDP of N292.52 trillion and an exchange rate of 669.79/$ by 2026, resulting in a GDP of $436.73 billion.

The analysis suggests that achieving a $1 trillion economy by 2026 would require significant economic growth and stability in the exchange rate, which appears unlikely under current macroeconomic conditions. The recent reforms, including the unification of the forex market by the Central Bank of Nigeria (CBN), aim to drive liquidity and stability but have faced challenges leading to further market instability.

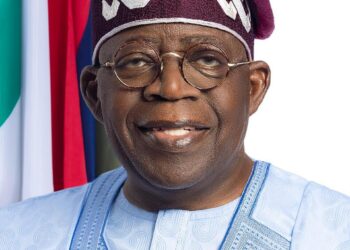

President Bola Tinubu’s ambitious target of growing the economy to $1 trillion by 2026 and $3 trillion by 2030 underscores the need for comprehensive economic reforms and stability in the forex market to achieve these goals. The recent initiatives by the CBN aim to strengthen the naira against the dollar and boost Nigeria’s GDP in dollar terms, but sustained efforts will be crucial to realizing these ambitious economic targets.