A recent report by Standard Bank’s African Markets Revealed (AMR) for January 2024 has projected a notable increase in Nigeria’s current account surplus, reaching approximately 1.8 per cent of Gross Domestic Product (GDP) in 2024, compared to the estimated 1.0 per cent in 2023.

The optimistic outlook hinges on expected growth in oil production, with a focus on supplying the Dangote Refinery and boosting oil export volumes.

A current account surplus, indicative of more exports than imports, is viewed positively as it contributes to a country’s reserves. However, the report acknowledges potential downside risks, particularly the ongoing weakness in global oil prices amidst slowing economic growth.

The report highlights key factors influencing the economic landscape, including increased oil refining from the Dangote Refinery and the Nigerian National Petroleum Company Limited (NNPCL), potentially reducing the demand for imported petroleum products.

It also points to challenges in non-petrochemical goods imports, citing poor FX liquidity and naira weakness as potential hindrances.

Despite the overall growth prospects, the report identifies several downside risks, such as FX liquidity challenges, high inflation, heightened insecurity, and lower crude oil production.

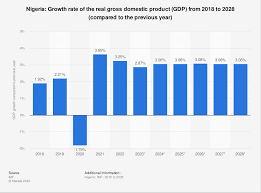

The Nigerian economy is forecasted to grow by 3.4 per cent year-on-year in real terms in 2024, surpassing the estimated 2.6 per cent for the previous year.

Standard Bank’s optimism is centered on expectations for the oil sector, projecting an 11.8 per cent year-on-year growth. Crude oil production, including condensates, is expected to increase significantly to 1.59 million barrels per day in 2024, up from an estimated 1.43 million barrels per day in 2023. Efforts to combat crude oil theft and vandalism, coupled with new production streams, are anticipated to contribute to this growth.

The report also notes potential challenges in the manufacturing sector, citing FX volatility, liquidity issues, elevated consumer prices, and rising interest rates. However, the commencement of operations at the Dangote Refinery is anticipated to boost oil refining, contributing to a 2.4 per cent year-on-year growth in the sector in 2024.

Furthermore, the agriculture sector is expected to experience faster growth in 2024, with a projected 2.2 per cent year-on-year increase in real terms. The report attributes this growth to improved output, supported by low base effects from periods of lower productivity due to adverse weather conditions in food-producing regions.

While the report predicts higher economic growth in the medium term, it acknowledges that reforms remain crucial for achieving desired results.

On the foreign exchange (FX) outlook, the bank anticipates a weakening of the naira to N1,171 against the US dollar by December, with potential gradual improvement in foreign private sector inflows as confidence in CBN reserves returns to the market.