Today, delivering finance-related services has moved from traditional banking activities like sending and safe-keeping money to more advanced approaches. These new ways of performing finance-based transactions thrive majorly due to the common use of technological devices in business dealings.

1 Because of these digital options, delivering financial services like sending and receiving money no longer requires business partners to meet physically. As such, business transactions are made easily and at people’s convenience in any location in the world, including Africa, through digital wallets and payment platforms.

A digital wallet is a technology-enabled purse on an electronic device that enables individuals or businesses to make electronic transactions.2 Some global digital wallets that have revolutionised digital payment today are Apple Pay, Paypal, Venmo, Alipay, Google Pay, Samsung Pay, and many others.

3 These digital wallets are widely used globally and have made a significant financial footprint for growth in many parts of the world. The global mobile wallet market is rapidly expanding due to the prevalent use of smartphones, smartwatches, and financial cards and the flexibility and convenience that such usage accords to digital payment.

Due to the high influx of users using and patronising these digital wallets and the associated products, the market worth of digital wallets was valued at $2,140.18 billion in 2023 and is forecast to reach USD 7,857.70 billion by 2030, according to MarkNtel Market Research Report.

4 The rise of digital wallets has been facilitated largely by the advent of devices equipped with next-generation technologies that enhance contactless payments. Users can tap on their phones and smart devices to transact.

This technology is circulating like wildfire worldwide, and Africa is not left out of it. In Africa, the rise in the adoption of digital payment and wallets has been occasioned by the same catalysts, such as the internet and the advent of mobile devices, as has been experienced in other parts of the world.

This has also caused the adoption of digital wallets and payment channels in Africa for financial transactions as a reliable solution to cash payments. Some of the digital wallets and payment channels widely used in Africa are Airtel Money, M-Pesa in Kenya, MTN Mobile Money, introduced in 2009 by MTN Group in Ghana, Orange Money in Côte d’Ivoire, Tigo Pesa in Tanzania, and so many others. These digital payment platforms have garnered millions of users; for instance, Tigo Pesa has 12 million users,5 and with this multitude, have pushed the boundaries of financial service delivery by bringing digital services to people. These service providers offer various services, including money transfers, bill payments, and mobile banking, using several technologies, including USSD, NFC and QR codes.

The lack of traditional banking infrastructure, high mobile penetration rates, and the demand for affordable and accessible financial services are the notable primary features identified as responsible for the acceptance and success of mobile wallets in Africa.

However, compared to developed economies of the world, the terrain of operation has been different due to the varied levels of technological advancement between Africa and the West.

In Africa, the narrative about financial inclusion as it relates to digital wallets and payment solutions has been characterised by issues such as poverty, widespread advanced fee fraud and lack of firm institutions to tackle ethical disruptions in terms of usage, and the low but progressive educational level of citizens, particularly in remote regions of the African continent.

These challenges have denied Africa full inclusion as many internet users in the area are still banked and have not imbibed the use of digital wallets and other digital payment solutions. Moreover, from the customer’s perspective, moving from physical cash to digital cash requires trust and proximity, which is the responsibility of the operator.

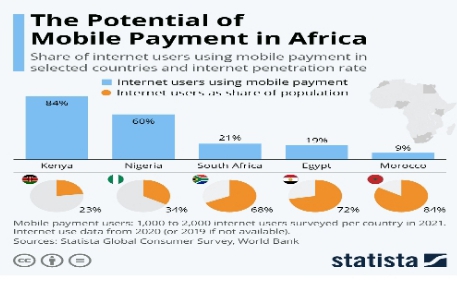

Therefore, the inability of operators and giants in the sector of digital finance to enshrine trust and bring financial services to people in hitherto remote and inaccessible regions has also contributed to the gap that exists between the users of digital wallets and those who do not, even though there are positive indicators that Africa is a viable region as there is high internet usage and penetration level as graphically depicted below: @statista The contrast between internet users and mobile payment users, as captured above, is responsible for Africa not being financially inclusive and the reason for her precarious economic condition.

This is because research has indicated that financial inclusion helps deal with access barriers to formal financial services, and financial technology (fintech) companies can deliver financial services at low cost to all areas, including remote areas, improving economic growth.6 It reflected that digitalisation is necessary to attain financial inclusion.

When the entire population is fully integrated into the digital finance space and unbanked, the chances of generating more revenue for the government, including individuals, are higher due to the shift from cash-based transactions to digital wallets.

To corroborate this, the introduction of quick response (QR) codes and the introduction of digital payments to remote regions in China by Alipay and Tencent reduced dependency on cash by 30% between 2011 and 2016.

They enhanced financial inclusion in that these regions could access financial services that were tailored to meet their needs.

7 From the foregoing, it is pertinent to note that Africa’s economic inclusion is possible if digital payment platform operators can provide access to financial services to those unbanked and living in remote areas. In conclusion, based on statistics of internet penetration and usage within Africa and its large population, it is obvious that Africa as a continent possesses the ability to thrive.

Still, her nations must adopt strategic measures such as those adopted by these developed economies if the continent is to realise or benefit from the gains engendered by digitalisation because, without a sound education and embrace of digital knowledge by all, Africa as a continent would not enjoy optimal financial inclusion as the developed economies of the world like USA, Canada, and others.