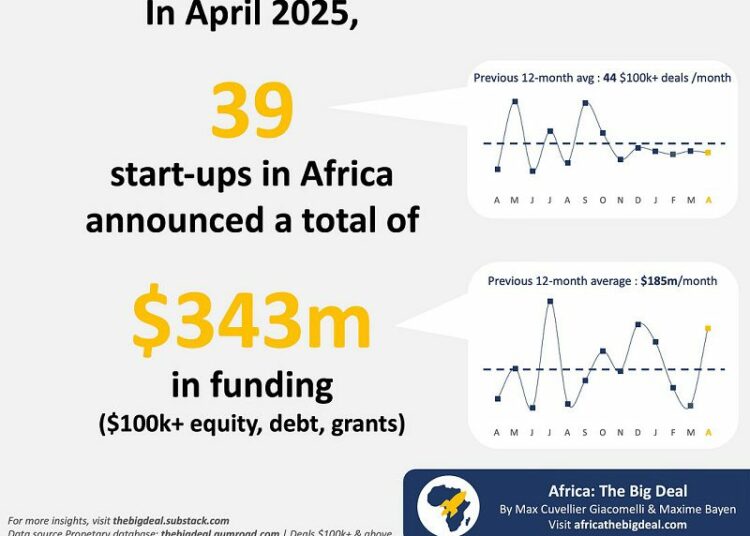

April 2025 marked a major rebound for Africa’s tech ecosystem as startups across the continent raised a total of $343 million in disclosed $100,000+ deals, excluding exits.

Africa: The Big Deal Report revealed that the funding, spread across 39 ventures, not only reflects renewed investor interest but also ranks as the second-best April on record, topped only by the funding frenzy of April 2022.

The surge is particularly impressive when compared to the same period last year, with total April funding up 4.5 times from April 2024.

It’s a significant turnaround from a sluggish March and a strong indicator that investor confidence, while still measured, is on the rise.

Key to April’s performance were a few major deals that boosted the month’s total. South African healthtech company hearX made headlines with a $100 million deal through its merger with U.S.-based Eargo, making it the first mega deal of 2025 and signaling bold ambitions in the global hearing health market.

In Egypt, Islamic fintech platform Bokra raised an eye-catching $59 million through a sukuk issuance, less than a year after closing a $4.6 million pre-seed round.

Meanwhile, South African payments startup Stitch secured $55 million in follow-on funding from existing investors, doubling down on its goal to build end-to-end payment infrastructure across the continent.

Exits were also part of the month’s action, with at least four notable acquisitions. Egypt’s ADVA was acquired by UAE-based Maseera, Nigeria’s Bankly was scooped up by C-One Ventures, and South Africa’s Peach Payments acquired PayDunya to expand its reach in Francophone West Africa.

Looking at the year to date, the momentum is building. From January to April 2025, African startups have raised $803 million across 163 deals, up 43% from the $563 million raised in the same period last year.

More startups are accessing capital too, with 163 ventures funded this year so far, compared to 147 in early 2024. At least 225 unique investors have participated in these deals, signaling both breadth and depth in funding activity.

Venture capital backing is also looking healthier. Since early 2024, more than $1.3 billion has been raised by Africa-focused VC funds, including Janngo Capital (noted for its gender lens investing), Airnergize Capital, Verod-Kepple Africa Ventures, Saviu’s Fund II (focused on Francophone Africa), and LoftyInc Capital.

While industry watchers caution that two strong months don’t make a trend, the signs are encouraging. The ecosystem is showing not just signs of recovery, but signs of resilience with more funding, enhanced diversity in deals, and increased investor engagement.

In the marathon that is building Africa’s tech future, April was a strong sprint while 2025 is shaping up to be a promising year.