With less than 10 per cent of Bureau De Change (BDC) operators meeting the Central Bank of Nigeria’s (CBN) new capital requirements, the Association of Bureau De Change Operators of Nigeria (ABCON) is urgently calling for an extension of the recapitalisation deadline.

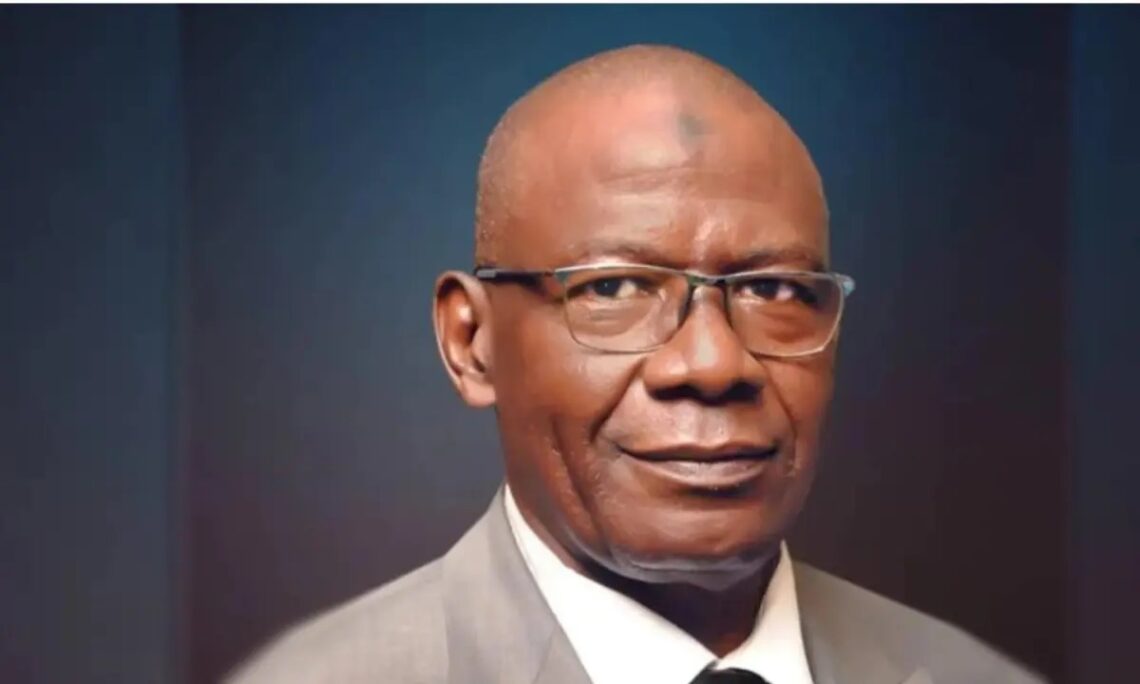

President of ABCON, Aminu Gwadabe, made the appeal warning that failure to extend the deadline and review the financial requirements could lead to mass job losses in the sector.

“The way forward to mitigate this is an appeal for further extension and a deliberate review of the financial requirements as some members strive to achieve them,” Gwadabe said.

“The CBN should continue their stakeholder collaboration during the extension to douse the anxiety, pressures, and tension currently enveloping the sector.”

He noted that despite a previous six-month extension granted by the apex bank, only a small fraction of BDCs have been able to raise the required capital, putting over three million jobs and livelihoods at risk.

In May 2024, the CBN introduced revised operational guidelines mandating a minimum capital base of N2 billion for Tier 1 BDCs and N500 million for Tier 2, effective June 3, 2025. It also directed all existing operators to reapply for fresh licences and pay non-refundable fees of N5 million (Tier 1) or N2 million (Tier 2).

Gwadabe disclosed that ABCON is engaging the CBN and other stakeholders to prevent widespread business closures. He said the association is also holding strategy sessions with members to explore mergers and public limited liability structures.

“We have applied to the CBN for a ‘No Objection’ on our plans to float a public limited liability company to absorb many of our members but met a holding response from the CBN,” he said.

He added that members are encouraged to form clusters and consolidate into larger entities that can meet the capital requirements, suggesting groups of five to 20 operators coming together to float new ventures.

“The acceleration of the licensing process will give hope, clarity, and direction to the investors who have met the requirements and the prospective investors,” he said.

The recapitalisation policy is part of the CBN’s broader efforts to reform and strengthen the foreign exchange market.