Nigeria’s capital market will migrate to a two-day (T+2) settlement cycle from November 8, following approval by the Securities and Exchange Commission (SEC), the Central Securities Clearing System (CSCS) said on Wednesday.

Haruna Jalo-Waziri, chief executive officer of CSCS, called the transition “a major milestone” that aligns the market with global standards while boosting liquidity and investor confidence.

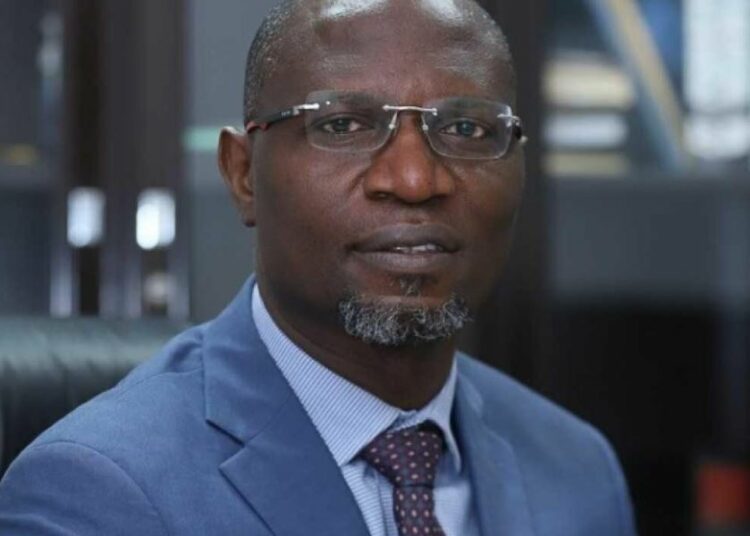

“T+2 settlement is a financial market process where the exchange of ownership of a security for money is completed two business days after the trade date,” Jalo-Waziri explained. The system replaces the existing T+3 cycle.

He added, “The transition to T+2 is a major milestone for the Nigerian capital market and reflects the collaborative spirit of our ecosystem. This shift aligns our market with global best practice while strengthening efficiency, resilience, and investor trust. CSCS is proud to coordinate this journey with the support of regulators, exchanges, and stakeholders.”

According to Jalo-Waziri, a settlement cycle review committee (SCRC), coordinated by CSCS, carried out a multi-phase assessment and submitted its framework to the SEC for approval before the migration was cleared.

Ahead of the switch, a webinar themed: “Advancing Market Efficiency Through T+2 Settlement,” will be held on September 10, with participation from the SEC director-general and chief executives of Nigeria’s securities exchanges.

Capital Market Switches To 2-day Settlement Nov 8

ANOTHER GOOD READ

Most Recent

Stock Market Gains N618bn On Renewed Interest In Blue-Chip Stocks

September 27, 2025

NEPZA Seeks U.S. Partnerships To Boost Jobs, Expand Exports

September 27, 2025

Nigeria’s Commitment To Non-Oil Exports Sacrosanct – NEPC

September 27, 2025

Minister Pushes for Sustainable Financing to Unlock Nigeria’s Blue Economy

September 27, 2025