After completion of its second tranche of N50billion capital raise, Wema Bank Plc now has N264.87billion total capital, which is above the minimum requirement of N200billion for a Commercial Bank with National Authorisation.

The bank, while disclosing this on Thursday, noted that, it has received all requisite regulatory approvals for its N50 billion Private Placement capital raise, in addition to the earlier N150billion Rights Issue that was successfully completed in September 2025.

This development, the bank said, marks another significant milestone in the execution of its capital management programme aimed at fortifying its balance sheet, supporting future growth ambitions, and ensuring full compliance with the Central Bank of Nigeria’s (CBN) revised minimum capital requirements.

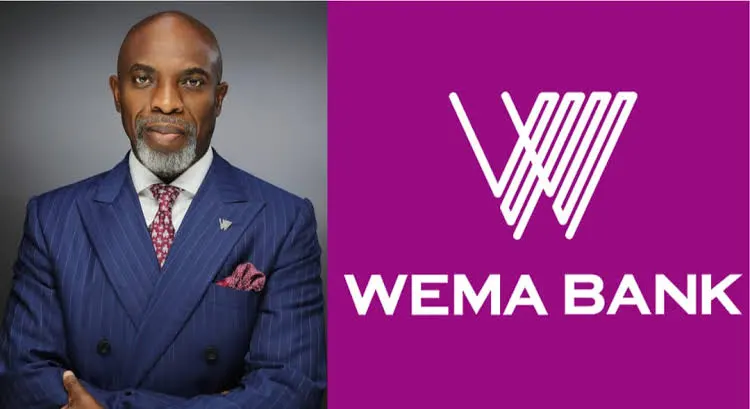

Speaking on the development, managing director/chief executive officer of Wema Bank, Moruf Oseni said, “We are delighted to have received all necessary regulatory approvals for our N50 billion special placement. This marks another major step in our strategy to strengthen Wema Bank’s capital base, enhance liquidity, and position the institution to pursue emerging opportunities for sustained growth. We appreciate the continued confidence and support of our shareholders, regulators, and customers as we execute our growth agenda.”

The proceeds from this capital raise, he stated, will be deployed to continue the acceleration of Wema Bank’s digital transformation drive, deepen penetration across retail, SME, and corporate segments, and enhance the Bank’s lending capacity to key productive sectors of the Nigerian economy.

This is even as it said, it will also support ongoing investments in technology, and human capital development — further strengthening operational efficiency and service excellence.

Wema Bank, the pioneer of Africa’s first fully digital bank, ALAT, offers a range of retail, SME banking, corporate banking, treasury, trade and financial advisory services to its customers. Wema Bank operates with a National Banking licence, with a network over 160 branches and service centres across Nigeria, backed by a robust ICT platform