In the pulsating heartbeat of Nigeria’s economic landscape, the revival of digital currency adoption emerges as a crucial cadence, echoing the promise of innovation and financial inclusivity.

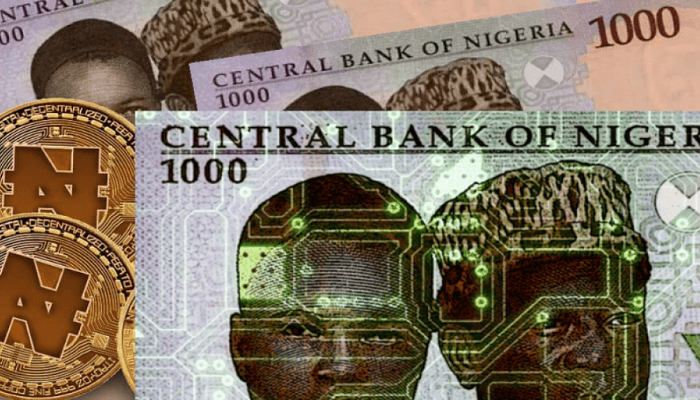

The immediate past administration of the Central Bank of Nigeria (CBN) under the erstwhile governor, Godwin Emefiele, had marshaled the introduction of a digital currency with the e-naira. That initial zest seems to have lost steam with the change of administration.

But with the new normal of daily erosion in the value of the naira and the palpable failure to effect monetary policies, the call to sustain the drive for a veritable e-naira cannot be over-emphasised.

To breathe life into this transformative vision, a symphony of strategic measures must be orchestrated, harmonising education, infrastructure, regulatory frameworks, and incentives.

At the forefront of this revival stands the imperative of education. Launching an expansive campaign that permeates the fabric of society, these initiatives should unfurl the intricacies of digital currencies. From bustling urban centers to remote villages, workshops and seminars should illuminate the benefits – efficiency, security, and financial empowerment – that digital currencies bring. A nation enlightened is a nation poised for progress.

Simultaneously, the pillars of financial literacy must be fortified with a specific focus on digital currencies. Empowering individuals with the knowledge to navigate this digital terrain not only instills confidence but also dismantles barriers born of unfamiliarity. It is through understanding that apprehension gives way to acceptance.

In the corridors of power, regulatory clarity must shine as a beacon. Crafting frameworks that provide a secure and favourable environment for digital currencies will dispel uncertainty, fostering an atmosphere ripe for innovation and adoption. By weaving a tapestry of rules that balances protection and encouragement, the government can lay the foundation for a robust digital currency ecosystem.

Collaboration, a melody of partnership, should resound between traditional financial institutions and the burgeoning digital economy. Integrating digital currency services into the offerings of established banks bridges the gap between conventional finance and the avant-garde, simplifying the transition for individuals and businesses alike.

The sinews of technological infrastructure must be strengthened. Investment in reliable digital payment systems, ubiquitous internet access, and an unwavering electricity supply forms the backbone of a digital future. These foundations, once fortified, provide the stable ground upon which the digital currency ecosystem can flourish.

To marshal widespread acceptance, government agencies should lead by example. Adopting digital currencies for transactions and payments showcases a commitment to this financial evolution, dispelling skepticism and legitimising these digital assets in the eyes of the public.

For merchants, the unsung heroes of economic transactions, incentives should be unfurled like banners of encouragement. Reduced transaction fees, tax benefits, and other enticements pave the way for businesses to open their doors to digital currencies, transforming them from curious novelties to practical instruments of commerce.

Commenting on the need to strengthen the digital currency environment, a tech expert in Lagos, Julius Evore, remarked that in the crucible of innovation, the possibility of a Central Bank Digital Currency (CBDC) should be explored. He said such a government-backed digital currency not only bolsters confidence but also provides a stable, regulated alternative for users, aligning with the global trend towards state-sanctioned digital currencies.

He also stated that local fintech startups, the vanguards of technological progress, should be welcomed into the fold. He added that collaboration with these innovative minds can birth solutions that bridge gaps and address the unique challenges of Nigeria’s digital currency landscape.

Further commenting on the benefits of digital currency for Nigeria, Zakari Mohammed, a lecturer at Auchi Polytechnic, noted that as Nigeria endeavours to revive the adoption of digital currencies, international partnerships become the bridges connecting diverse experiences and best practices. He said by learning from the successes and pitfalls of others, Nigeria can navigate its digital currency journey with greater wisdom and foresight.

Still commenting, James Igbrude, an economist and economic affairs analyst, cited that in the grand tapestry of Nigeria’s economic revival, the strands of digital currency adoption weave a narrative of progress, inclusion, and empowerment. He stressed that through a concerted effort to educate, regulate, innovate, and collaborate, Nigeria can orchestrate a harmonious future where digital currencies resonate as instruments of economic transformation, playing a vital role in the symphony of progress.

But for now, it would seem as though the apex bank was veering into another direction in the e-currency disruption.

The Central Bank of Nigeria (CBN) is venturing into the realm of Central Bank Digital Currency (CBDC), and the focus has shifted significantly from the previous e-Naira initiative. The CBN governor, Yemi Cardoso, a key figure in this endeavor, does not seem to be outright opposing the concept of CBDC; rather, he is steering the approach in a different direction, as per insiders familiar with the matter. This redirection implies a divergence in budget allocation and expenditure compared to the billions already invested in the eNaira, which has yielded minimal tangible results for the country.

The CBN’s latest CBDC initiative is named cNGN, setting it apart from the eNaira. Notably, unlike the eNaira, which is entirely overseen by the CBN, the cNGN token is set to be both created and managed by tier 1 banks. The primary aim is to accrue benefits for the token holders and bolster the overall economy.

One pivotal aspect of the cNGN token is its reliance on an interoperable blockchain. In essence, this means that the cNGN will not be restricted to the control of the CBN alone. External entities beyond the central bank will have access to this blockchain, facilitating seamless interaction and transferability. The cNGN’s interoperability extends to its capability to connect with other public blockchains, enabling users to transfer funds globally.

It is noteworthy that the eNaira closed its first full year as a financial service in negative. According to a report by the International Monetary Fund in May 2022, the total volume of transactions at 802,000 was less than the number of downloaded wallets at 919,000. The number of wallets rose to 13 million and the value of transactions grew by 63 per cent to N22 billion in 2023, a report by Bloomberg showed. Unfortunately, the number of app installs has remained below 1 million on the Google Play Store and the reviews continue to be unflattering.

Whatever the outcome, a financial economist at Nnamdi Azikiwe University, Felix Echekoba, insists that seamless transactions always fertilise economic growth, hence the need to ensure the success of Nigeria’s digital currency considering the unstable local currency.

Dr. Omobola Adu, a Research Analyst at GDL, expressed a positive view on the e-Naira, considering it a good initiative in line with the global trend toward digital currencies.

However, Dr. Adu said the e-Naira is merely a digital representation of the existing physical currency. He emphasised that the value of the Naira, whether in physical or digital form, is influenced by factors such as demand and supply dynamics, as well as production levels.

He underscored the ongoing relevance of existing factors like demand and supply, as well as the overall production levels, in determining the value of the Naira, regardless of its form.

Dr. Adu sees the e-Naira as a positive step toward digital currencies, he highlighted the importance of broader economic factors in determining the value of the currency, both in its physical and digital manifestations.

Dr. Omobola Adu, a Research Analyst at GDL, emphasised that traditional economic factors, such as demand and supply dynamics and production levels, would remain pivotal in determining the currency’s value.

In a contrasting view, Dr Ifeoluwa Ogunrinola, a lecturer at Covenant University voiced concerns about the e-Naira potentially inheriting the volatility associated with its paper counterpart, despite CBN’s assurance of pegging it to the fiat currency as a stablecoin. He cautioned that such volatility could diminish the advantages of transitioning to a digital version of the fiat money.

Nevertheless, Dr. Ogunrinola remained optimistic about the potential positive outcomes if implementation challenges are effectively addressed. He highlighted benefits such as enhanced financial inclusion, streamlined trade settlements, and a potential reduction in administrative costs linked to paper money.

Dr. Ogunrinola pinpointed critical hurdles in the implementation process, particularly emphasising the need for establishing public trust and acceptance. Additionally, he drew attention to potential obstacles related to the costs of hosting servers and data centers, emphasising the need for careful consideration and strategic planning in this regard.