Lead Asset Management Limited has unveiled plans to launch a $1 million Dollar Fixed Income Fund, focusing on investments in US dollar-denominated fixed income securities. The company made this announcement on August 11, 2023, during a signing event at its headquarters in Lagos.

The initial capital for the dollar fixed income fund stands at $1 million, marking its initial investment amount. Investors are being encouraged to participate in the subscription offer of 1,000,000 units at a price of $1.00 per unit.

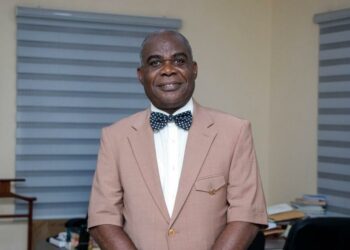

Mr. Taiwo Olashore, the Managing Director and CEO of Lead Asset Management Limited, provided further insight into the fund’s purpose in an exclusive conversation with Nairametrics:

“The decision to launch this fund stems from our observation of the fluctuating exchange rate between the dollar and the naira.

“We have clients who already have dollar investments with us, but we also wanted to introduce a retail product that we can offer to the general public. That’s the rationale behind launching this fund,” he said.

Olashore explained that this marks the company’s third fund offering, as part of its strategy to diversify its product portfolio and better cater to its clients and the broader investing public:

“Our inaugural fund was the Lead Fixed Income Fund, catering primarily to those interested in fixed income instruments. This fund has shown steady growth.

“The second fund we introduced was the Lead Balanced Fund, which includes an equity component for clients interested in the stock market but may not be well-versed in selecting individual stocks.

“We recognise that some clients seek diversification, hence their interest in investing in the dollar fixed income fund.”

Olashore outlined the subscription details for investors interested in the Lead Dollar Fixed Income Fund:Minimum investment: $1,000; Additional subscription: $500

The fund caters to various types of investors, including Retail Investors, Institutional Investors, and High Net Worth Individuals (HNIs).

The introduction of the dollar fixed income fund aligns with Lead Asset Management’s commitment to expanding its range of investment options, catering to the preferences and needs of a diverse range of investors.