Investment experts have urged investors to stay informed and agile to successfully navigate uncertainties and optimise investment portfolios.

The experts, who spoke at a webinar organised by Sovereign Finance Company Limited (SFL) on ‘Sustainable Investment Strategies for Changing Times,’ noted that

[contact-form][contact-field label=”Name” type=”name” required=”true” /][contact-field label=”Email” type=”email” required=”true” /][contact-field label=”Website” type=”url” /][contact-field label=”Message” type=”textarea” /][/contact-form]

preading investments across various assets or asset classes is crucial to reduce risk.

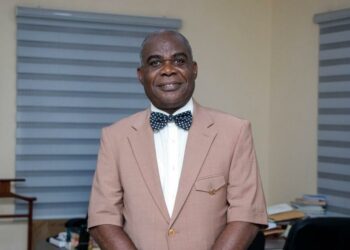

On his part, the managing director, SFL, Mr. Olusola Dada, said spreading investments lessens the impact of a decline in any single investment, especially, during uncertain times like economic downturns or market volatility.

The MD of Sovereign Finance recommended four sustainable investment areas, namely; defensive sectors, diversified portfolios, real estate investment trusts (REITs) and emergency savings and liquid assets.

“Investors should consider investing in defensive sectors that are less sensitive to economic downturns, such as healthcare, utilities, and consumer staples. These sectors tend to have more stable demand for their products and services regardless of economic conditions,” he said.

In addition, he said, investors should “invest in diversified portfolio products that spread investments across multiple asset classes, thereby reduce risk by spreading exposure across different types of investments and market segments.”

Revealing that, in uncertain economic times, it’s equally essential to maintain an emergency fund consisting of liquid assets such as cash, savings accounts, and short-term deposits, he added that, having readily accessible funds can provide a financial buffer in case of unexpected expenses, job loss, or economic downturns, helping to avoid the need to liquidate long-term investments at inopportune times.

He stressed the necessity for investors to clearly define their objectives, regularly review their financial goals, and adjust their investment strategies accordingly to align with evolving needs and circumstances.

On his part, an expert, Mr. Temidayo Osanyintade explained that, diversification is a proven investment strategy that involves spreading investments across different assets or asset classes to reduce risk.

He said , “By diversifying your investments, you spread risk across various assets, reducing the impact of a decline in any single investment. During uncertain periods, such as economic downturns or market volatility, having a diversified portfolio can help cushion the impact of adverse events.”

Diversification allows investors to capitalise on opportunities across different sectors or markets, he added.

Sovereign Finance Company Limited is a financial services provider with a prime desire to promote trailblazing Financial & Investment solutions to customers in different sectors of the Nigerian economy, through innovative and bespoke products across Investments, Loans and Leases and extensive expertise to provide impactful Financial advisory services and professional guidance to achieve desired objectives.