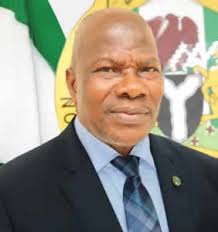

Commissioner for insurance, Mr. Sunday Thomas, has stated that insurance penetration in Nigeria is projected to increase from the current rate of 0.4 per cent to 2.1 per cent by the year 2033.

He made this announcement while delivering the opening address at the 2023 Insurance Directors’ Conference organized by the College of Insurance and Financial Management (CIFM) in Lagos.

The theme of the conference: “The Board and Insurance Business Sustainability,” reflects the sector’s focus on enhancing sustainability and expanding its role in the economy.

Commissioner Thomas emphasized that deeper penetration would significantly improve the rating of the Nigerian insurance market on the global insurance map.

This growth projection aligns with the recently launched Nigerian Insurance Industry 10 Year Strategic Transformation RoadMap. Thomas explained that the strategic roadmap aims to revolutionize the insurance sector with a well-coordinated implementation approach. The roadmap outlines seven strategic thrusts, including transforming the regulatory environment, transitioning to a risk-based capital model, and promoting insurance awareness and adoption.

Other thrusts include broadening insurance product offerings, improving the effectiveness of distribution channels, enhancing digitisation in the insurance industry, and deepening the industry’s talent pool and capabilities. Thomas highlighted that the sector’s transformation aligns with Nigeria’s economic transformation and sustainability agenda.

While acknowledging the insurance industry’s steady year-on-year growth of 15.1 per cent in premium income, Thomas emphasized the need to maximize the sector’s share of the growing Contributory Pension Scheme (CPS), which has cumulative assets exceeding N17 trillion. He urged the insurance sector to transition from being perceived as “too conservative” to adapting proactively to the current and emerging environment.

The commissioner called on the industry’s board of directors to support the government’s efforts to revive the economy and derisk individual and business ventures. He stressed the industry’s crucial role in realizing national economic objectives.

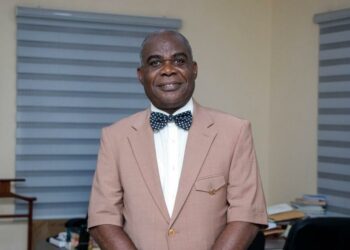

In his address, Mr. Edwin Igbiti, President of the Chartered Insurance Institute of Nigeria (CIIN), emphasized the responsibility of the board of directors in ensuring the viability and sustainability of the insurance industry. Igbiti highlighted the critical role of technology in driving efficiency, productivity, and sustainability in insurance operations.

The conference brought together over 150 board directors of insurance companies in the country to discuss strategies for enhancing sustainability and expanding the industry’s role in Nigeria’s economic development.