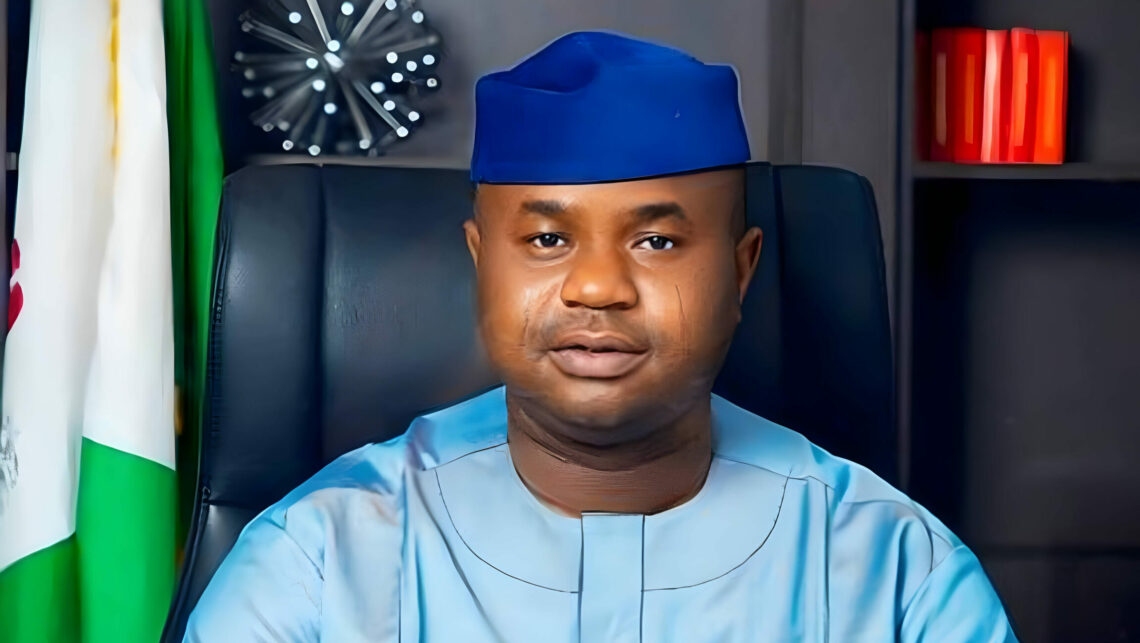

The federal government is set to introduce new tax laws by September, with specific regulations for the cryptocurrency industry. This announcement was made by executive chairman of the Federal Inland Revenue Service (FIRS), Dr. Zacch Adedeji, during the 2024 FIRS Stakeholders Engagement with the Senate and House of Representatives Committees on Finance in Lagos.

Dr. Adedeji emphasised the absence of a legal framework governing cryptocurrency in Nigeria, stressing the urgent need for regulation. With Nigeria’s cryptocurrency industry valued at up to $400 million and about 33 per cent of the population holding some form of cryptocurrency, the lack of regulation poses significant challenges.

A report by Chainalysis indicated that Nigeria’s cryptocurrency transaction volume saw a 9 per cent year-over-year growth, reaching $56.7 billion between July 2022 and June 2023. Dr. Adedeji highlighted that the forthcoming tax laws aim to overhaul the nation’s revenue administration, harmonise and simplify existing tax regulations, and support President Bola Tinubu’s economic plan.

“For example, the stamp duty tax law of 1939 was established before the internet or local governments existed. Part of the reason President Bola Tinubu set up the Tax and Fiscal Reform Committee is to address these outdated laws by September,” Dr. Adedeji explained.

He also pointed out the need for a legal framework to regulate cryptocurrency transactions, noting that while cryptocurrency cannot be avoided, it must be managed to ensure it does not hinder Nigeria’s economic development. “When there are innovations in a system, you must plan to regulate it in a way that is not injurious to the economic development of Nigeria,” he said.

Dr. Adedeji expressed gratitude to the National Assembly for its continuous support, which has enabled the FIRS to meet its targets and facilitate wealth distribution. He also noted that the FIRS is on track to achieve the N19.4 trillion revenue target set by the National Assembly at the beginning of the year.

Chairman of the Senate Committee on Finance, Senator Muhammed Musa, underscored the importance of regulating the cryptocurrency industry to provide the country with appropriate legislation for tax collection and revenue generation. He noted that this process would allow for the modernisation of tax laws that have been in place since before Nigeria’s independence.

The lawmaker expressed confidence that the Executive would submit the necessary bill after the Senate resumes recess, enabling amendments, repeals, and the re-enactment of laws that align with current trends. He also noted that while cryptocurrencies have become a significant means of generating income, Nigeria currently lacks the legal framework to govern this sector.