Nigeria and other sub-Saharan African (SSA) countries, where inflation remains persistently high and significantly exceeds central bank targets, will need prolonged monetary tightening to combat the ongoing price crisis, according to the International Monetary Fund (IMF).

The IMF made this recommendation in its SSA Regional Economic Outlook, just released. However, the Fund warned that excessively tight monetary policies could intensify social tensions. It urged policymakers to implement measures that alleviate the burden on the most vulnerable individuals and households.

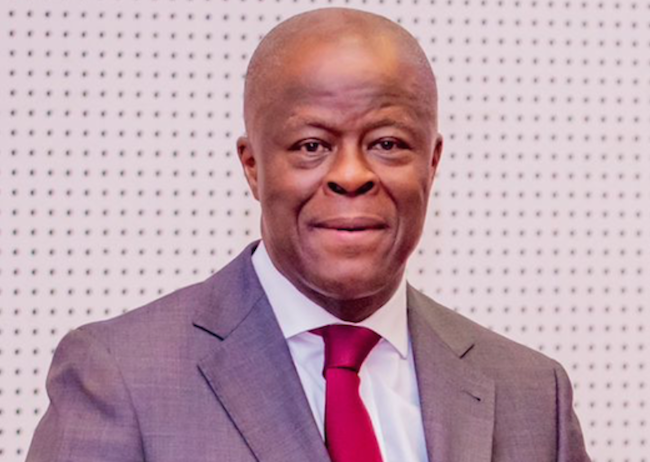

Nigeria’s inflation rate, currently over 33 per cent, far outpaces the rest of the continent. The Central Bank of Nigeria (CBN) has responded by raising the interest rate to 27.25 per cent, maintaining a strong stance on curbing inflation despite potential adverse economic effects. At the recent World Bank/IMF Annual Meetings, Wale Edun, Minister of Finance and Coordinating Minister of the Economy, emphasised that it would be premature for the monetary authorities to consider reducing rates.

With inflation resuming its upward trajectory due to holiday-driven spending, the CBN’s Monetary Policy Committee (MPC) is expected to increase the already elevated interest rate during its upcoming meeting.

The IMF noted that countries with more moderate economic imbalances could consider easing monetary policies toward a neutral stance, provided they carefully monitor inflation outcomes, expectations, and exchange rate fluctuations due to their impact on inflation. A gradual easing of monetary policy could also help mitigate the high costs associated with public debt servicing.

Within the SSA region, interest rate policies vary significantly. Nigeria’s rate of 27.25 per cent is the highest, while countries like those in the West African Economic and Monetary Union (WAEMU), Botswana, and Mauritius maintain much lower rates of 4 to 6 percent. Analysts warn that another interest rate hike in Nigeria could push commercial lending rates to nearly 40 per cent, discouraging private investments. Pro-private sector advocates have called on the CBN to consider easing monetary policy to unlock funding critical for economic growth.

The IMF also highlighted the potential benefits of increased exchange rate flexibility for some SSA countries, suggesting that it could support policy adjustments. However, the Fund cautioned that such moves might pose financial stability risks, particularly due to currency mismatches on banks’ balance sheets. To address these challenges, it recommended stronger capital buffers and improved regulatory frameworks.

Debt sustainability emerged as another critical issue in the IMF’s report. It noted that some SSA countries might face inevitable debt restructuring, a process that could ease fiscal pressures but comes with “significant economic and social costs.”

The Fund emphasised that achieving macroeconomic stability would require a carefully calibrated policy mix, tailored to the size of economic imbalances and political constraints. In many cases, frontloaded adjustments may be necessary due to tight financing conditions. While this approach could boost the credibility of economic reform plans and reduce sovereign borrowing costs, it risks aggravating economic hardships and intensifying social tensions, potentially undermining public support for reforms.

To simplify its recommendations, the IMF outlined three broad scenarios for policy adjustments, while stressing that decisions must remain specific to each country’s unique circumstances.