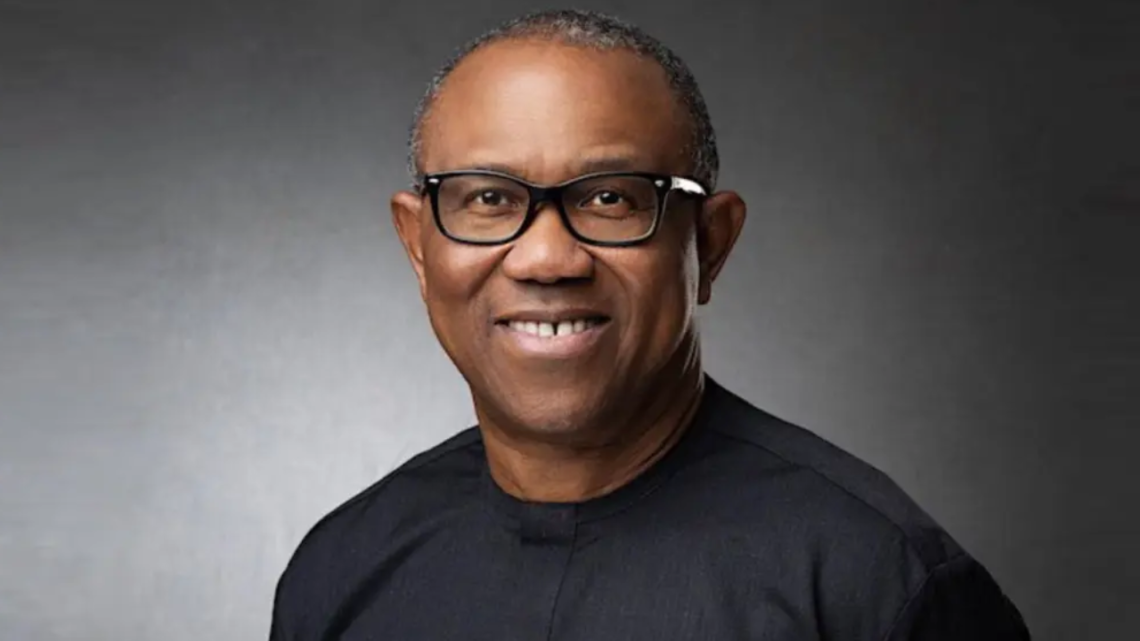

Peter Obi, the Labour Party’s presidential candidate in the previous general election, has raised concerns to the federal government regarding the continuous escalation in exchange rates for cargo clearance, asserting its detrimental effects on businesses and inflation across the nation.

In a statement released on Wednesday, Obi urged the government to halt the arbitrary and persistent surge in customs duties, highlighting the significant danger it poses to the economy.

The former governor of Anambra State pointed out the distressing scenario where importation processes are initiated based on specific exchange rates, only for duties to be calculated at different rates upon arrival in Nigeria.

This discrepancy, he emphasized, presents serious challenges to businesses, resulting in losses and contributing to inflationary pressures.

Obi stressed the importance of policy consistency, asserting that it would facilitate better economic forecasting and enable businesses to plan effectively.

He lamented that the inconsistency in import duties is driving businesses to collapse and causing manufacturers to cease production.

“We cannot afford to target high customs revenues at the expense of the survival of local businesses, employment, and reasonable cost of living,” Obi emphasized.

Since the beginning of the year, the Nigerian Customs Service (NCS) has been progressively increasing its foreign exchange (FX) rate for duties. In February alone, the agency has adjusted the rate six times, reflecting the volatility in the broader FX market.

Recent checks on the federal government’s single-window trade portal of the customs service indicate a notable adjustment in the exchange rate from N1444.56 to the USD to N1515.09.

The Nigeria Customs Service imposes duties on imported cargoes before clearance from the ports, with charges ranging from 5 per cent to 35 per cent depending on the harmonized commodity and coding system (HS code).

BUA Foods, one of Nigeria’s leading consumer goods producers, recently voiced concerns about the incessant adjustments in the import duty FX rate, citing their adverse impact on operations, particularly in the importation of raw materials. The company highlighted the challenges in planning due to the increases, echoing the sentiments expressed by Obi.