Operators in the downstream oil sector have seen a failed institutional capacity as responsible for the recurring scarcity of Premium Motor Spirit, PMS, which is called petrol.

They have also seen a near failure in a model adopted by the Nigerian National Petroleum Company Limited, NNPCL, as contributing to market disruptions.

In the view of operators the company is obviously not capable of sustaining its Direct Sale of Crude Oil and Direct Purchase of Petroleum Product (DSDP) model which it initiated to ensure sustained product supply in the country.

Data from the company shows that the total volume of petrol imported into the country between January and August 2022, was 16.46 billion litres, which translated to the 68 million litres daily supply.

The company maintained that import in 2021 was 22.35 billion litres, which translated to an average supply of 61 million litres per day.

It noted that the average daily evacuation (Depot truck out) from January to August 2022 stood at 67 million litres per day as reported by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA).

It explained that Daily Evacuation (Depot load outs) records of the NMDPRA do carry daily oscillation, ranging from as low as four million litres to as high as 100 million litres per day.

It also pointed out that the impact of maritime and cross border smuggling of petrol might be affecting the overall supply framework, acknowledging the possibilities of other criminal activities in the supply and distribution value chain.

NNPC further stated that rising crude oil prices and petrol supply costs above NMDPRA cap had forced oil marketing companies’ withdrawal from petrol import since the fourth quarter of 2017.

In the light of these challenges, the company explained that it had remained the supplier of last resort and continued to transparently report the monthly petrol cost under recoveries to the relevant authorities.

However, an independent consultant and former executive director of the NNPCL, Bello Rabiu, has faulted the operating model of the company’s downstream businesses saying that it has arguably contributed to a difficult investment climate for the private sector and made NNPC the single importer of PMS, limiting the space for competitive market.

Speaking at a virtual conference organised by the Major Oil Marketers Association of Nigeria, MOMAN, Rabiu said that unavailability of dollars to oil marketing companies at the official CBN FX window has shut them out of the import arrangement thus making the NNPC import all its products at the official exchange rate of N360 per US$.

Equally, he said that the inability of the then PPPRA to continue publishing the monthly guiding prices for the deregulated products has created confusion as to which exchange rate should be used for the importation of Petroleum products.

According to him, “Non compliance with the PPPRA regulations on monthly guiding prices for PMS; PPPRA renege on its responsibility to monitor the market and advise NNPC and other marketers on the appropriate guiding prices of PMS on a monthly basis, adding that insufficiency of market and industry information that would allow all importers and consumers to understand the basis for any change in price is lacking.”

He said further that the PPMC Ex-depot price is now the only basis for pricing PMS across the nation and Nigerians would therefore have to pay for any inefficiency associated with the monopoly supplier.

Rabiu, noted that a review of the current legislation and institutional arrangements establishes gaps which include conflicting provisions with respect to who has the power to fix the prices of petroleum products and that the Petroleum Act, 1969, Price Control Act of 1977, Petroleum Equalization Fund Act , Petroleum Product Pricing Regulatory Agency Act, 2003 all have varying provisions and powers on Petroleum Products Pricing and while the PPPRA has the power to “determine the pricing policy of petroleum products.”

“Whilst not as explicit as the previous legislations, the PPPRA Act, empowers an additional agency to settle prices of petroleum products, he noted but indeed, as a matter of practice, PPPRA has been determining the prices of petroleum products in the recent past through its pricing template.”

He stated host in the current context, it is difficult to establish the true cost of PMS importation into Nigeria, saying that when PPPRA were announcing the monthly guiding prices, the agency claims that the pricing template it published takes into account FOB cost, freight, trans-shipment cost, statutory and admin charges (NPA, NIMASA, PEF, etc), storage charges, financing costs, foreign exchange rate together with generous distribution margins for the oil marketing companies, transporters and retailers.

Rabiu, added that the Major Oil Marketers Association of Nigeria (MOMAN) insists that the cost of importation of petroleum products, especially PMS, is beyond the reach of its members, primarily due to unavailability of FX at the same rate applicable to NNPC.

“They also insist that distribution costs the template allots to marketers is inadequate to sustain their businesses.

“NNPC as the sole importer of PMS is utilising its domestic crude oil allocation to import PMS under the DSDP arrangement, thus benefiting from unrestricted access to FX at official rate of N360 per US$. Oil Marketers would end up with a higher landing cost that is at least 25% higher than NNPC’s if they procure FX at N480.”

He insisted that to address the issue of establishing the true cost of importation of products, PPPRA should resume the publication of key elements of its templates such as FOB Costs and FX rates as this would allow all consumers and other stakeholders to understand the basis for any change in price.

He declared that, “As long as NNPC remains a sole importer of PMS, the total cost of importing the product should be publicly disclosed and the imported product should be shared to all eligible wholesalers at cost.

Making recommendations he said that to minimise actual cost for products importation, estimated at over 80 per cent of the current pump price, government should carry out a benchmark audit on the current DSDP arrangement to determine if it is still cheaper than cost incurred by other Oil Marketing Companies (OMCs).

This he said is necessary at this stage of our deregulation journey when NNPC is still the sole importer of PMS due to inability of other OMCs to secure adequate forex for their imports;

“If the OMCs are able to import PMS at a cost lower than the NNPC’s DSDP arrangement, then NNPC should be encouraged to discontinue procurement under the scheme and join the OMCs in open market procurement of imported products.

“If the DSDP cost of import is lower than current OMCs import cost, then DSDP arrangement should be adopted as a national strategy for the importation of products pending the resumption of operation of the NNPC refineries,” he said.

He also called for full and effective implementation of the Petroleum Industry Act (PIA) 2021 which cleary provided for full deregulation of Petroleum Products Pricing and enhanced regulatory framework for the Petroleum industry.

In medium term strategies, he called for expansion of port capacity to receive liquid fuels in greater quantities or increasing the speed of discharge, increasing fuel storage capacity, and enabling cheaper transport of petroleum products (by pipeline or rail rather than road transport) are some of the ways to lower landing costs and petroleum pump prices.

Under a deregulated regime, focus of the regulator (NMDPRA), working with the competition regulator is to ensure that industry players are not involved in anti-competitive practices such as collusion and abuse of market share in establishing prices of petroleum products, he said.

Also he said NMDPRA should no longer play a role in fixing prices and setting price ceilings. The regulator must also ensure that all market-players (including the National Oil Company and its subsidiaries) are operating on a level playing-field.

Under long term strategies, he said effective operation of the network of pipelines and depots will depend on the continuous operations of the four refineries whose major rehabilitations are ongoing.

“Private sector investments into these critical infrastructures when reinforced with appropriate ownership and governance structures operating under a transparent and open access regulatory environment will guarantee sustainable development of a liberalised downstream petroleum sector,” he said adding that the decision to privatise or enter concessions with respect to the assets is a strategic one based on what the government perceives its future role in the sector to be and the market appetite for partnership with the government.

This he added should be underpinned by the objectives of securing the financing necessary to rehabilitate/develop the assets; and reducing the influence of government/NOC in operational decision-making.

He concluded by demanding that full deregulation of the downstream petroleum sector is a critical national economic and strategic endeavor requiring the support and cooperation of all stakeholders to implement.

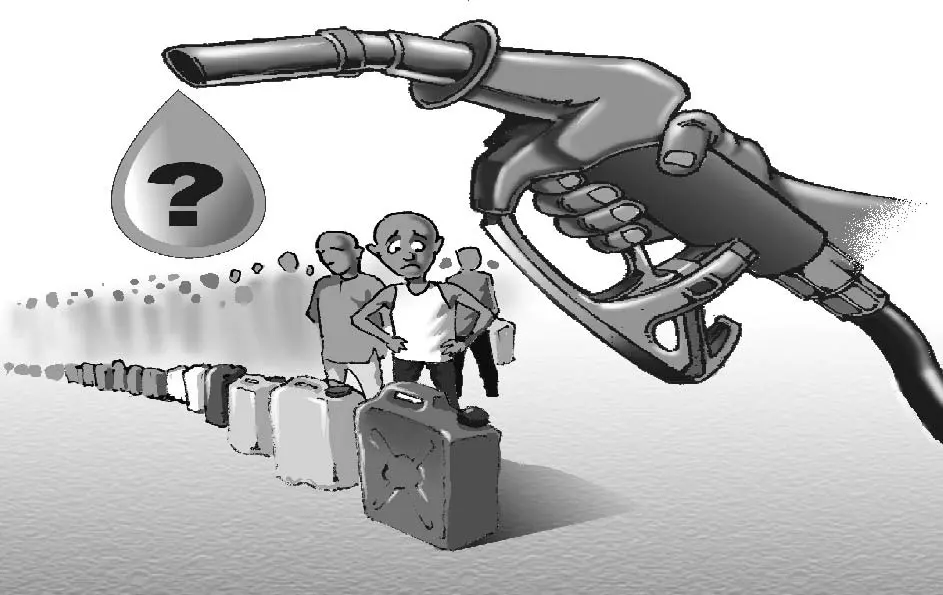

The MOMAN, on its part observed that frequent instability in supply and distribution of petrol across the country clearly shows institutional failure occasioned by inability of the system to absorb the subsidy regime.

MOMAN, notes that having subsidised PMS for so long, Nigerian institutions now have a diminished capacity to deal with the current local energy crisis, adding that any disruption in any part of the supply chain causes ripple effects and results in queues at stations.

“As a country, we must begin the process of price deregulation to reduce this inefficient subsidy. If the country wishes to implement a subsidy, it must be in areas targeted to help those it should help such as in agriculture and transportation to reduce food price inflation and generate more jobs for Nigerians,” the association said.

In addition it said that in tandem, the authorities must find a way to liberalise supply and also bring transparency and competition into supply to ensure steadier, more efficient supply at optimum prices.

According to MOMAN, imported products must compete with locally refined products to find a meeting point between the need for local refining and competitively low but cost recovered prices for Nigerians for sustainability.

The association said the the dialogue with the Nigerian people needs to begin to identify, negotiate and agree these areas and begin implementation to save the downstream industry which has been in degradation freefall due to a lack of investment to maintain, renew and grow assets and facilities such as refineries, pipelines, depots, trucks, and modern filling stations.

These lack of investments it said has contributed in no small measure to fuel distribution inefficiencies and high costs.

“Neither the new refineries nor the refurbished refineries will survive with the refining margins at current pump prices. The exploration, production, refining of crude oil and the distribution of refined products is an international business with ebbs and flows and has specific models, guidelines, rules, and norms designed to protect and sustain consumers of this type of energy and populations impacted by its supply chain.”

To cut corners would be irresponsible, unaccountable, and unsustainable, it warned and assured that members would continue to work with other key stakeholders to ensure that we ramp up supplies to our retail sites and return to normalcy as soon as possible.

“We envisage a rise in demand during the yuletide season and are prepared to work round the clock to keep our stations running. As always, MOMAN a full deregulation of the petroleum downstream sector in phases to cushion the effects of the impact of a sharp rise in PMS prices on the long-suffering, hardworking citizens of Nigeria.” it said.

Also, speaking at a Webinar organised by the MOMAN, for the media in Lagos, James Gooder, VP Crude & African markets, Argus, leading independent Price Reporting Agencies (PRAs), projected that January of 2023 may see extreme clean freight volatility in advance of February 5 ban.

Gooder however, said market is likely to rebalance as the year progresses and main wild cards are played and High freight, especially on Long Range and Medium Range tankers are likely to persist through the first half of 2023.