Nigeria’s import economy is undergoing a quiet but consequential recalibration. After nearly two years of bruising currency volatility that distorted pricing, disrupted inventories and crippled cash-flow planning, the naira’s rebound and relative stability against the US dollar are restoring a fragile sense of order to a system long defined by uncertainty.

The currency remains structurally weak, and few importers believe Nigeria’s foreign exchange challenges are over. But the shift from extreme volatility to cautious stability is already reshaping how goods are priced, sourced and financed across the economy. For businesses dependent on imports to survive, the difference is not theoretical. It is operational.

At the centre of this renewed confidence is the naira’s stabilisation after one of the steepest depreciations in its history. Having slid from about N450 to the dollar to nearly N2,000 at its worst, the currency has largely traded within the N1,450-per-dollar range since September last year. For importers, that stability has translated directly into lower landing-cost volatility, fewer price shocks and a return of discipline to business planning.

The earlier turbulence had fed directly into inflation, which climbed to about 34 per cent at its peak as imported costs surged across the economy. While inflation remains elevated, the combination of exchange-rate stability, data recalibration and tighter monetary and fiscal policies has slowed its acceleration, easing pressure on import-reliant sectors.

Crucially, the gains are being felt across industries that depend on imported finished goods, raw materials and services, though not evenly.

For traders on the front line, the most valuable dividend of the naira’s rebound has been predictability. Kingsley Obiora, an Abuja-based importer of household appliances, told NATIONAL ECONOMY that the era of daily repricing has largely faded.

“Before now, you could open Form M at one rate and clear goods at a completely different one,” Obiora said. “That uncertainty destroyed margins. With stability, even if the rate is still high, you can plan and survive.”

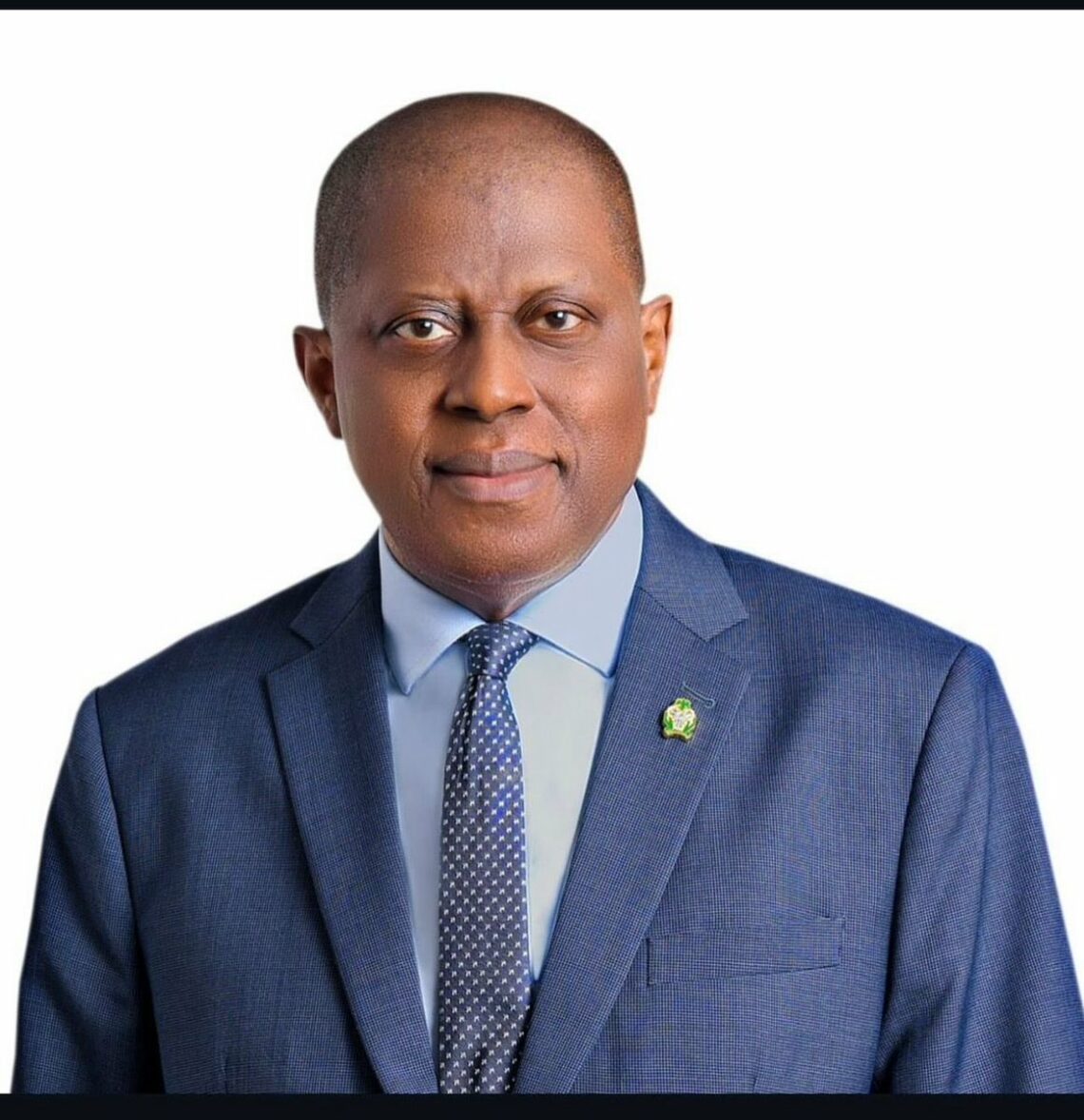

According to Dr Muda Yusuf, Chief Executive Officer of the Centre for the Promotion of Private Enterprise (CPPE), importers are benefiting from both exchange-rate stability and improved access to foreign exchange.

“These two developments, the improvement and strengthening of the naira, have brought down the cost of imports and made importation cheaper,” Yusuf said. “A few months ago, you would go to the supermarket and see one price in a particular week, and by the next week the prices had changed. It was so bad that some stores stopped putting price tags on products. That is no longer happening.”

For firms dependent on imported components, the impact extends beyond retail pricing. FX stability reduces the risks embedded in inventory decisions and lowers the chances of being trapped with overpriced stock after sudden currency swings.

Yusuf said sectors with high import dependence are seeing the clearest relief. Construction, aviation, information and communication technology, pharmaceuticals and segments of manufacturing are among the biggest beneficiaries.

“If you take the construction sector, apart from cement, virtually everything else used is imported,” Yusuf said. “So exchange-rate stability has real value for the sector. The more import dependent a sector is, the better it performs in a situation of exchange-rate stability and a stronger naira.”

Pharmaceutical distributors echo that assessment. Funmi Adeyemi, Managing Director of a Lagos-based pharmaceutical distribution firm, said the pressure to pass FX shocks directly to consumers has eased.

“Medicines are still expensive, but we are no longer repricing because the dollar suddenly jumped,” she said. “Hospitals can plan procurement, and distributors can manage inventory without panic.”

Manufacturers, FMCG companies and organised retailers are also seeing benefits. According to Yusuf, FX stability reduces uncertainty in production planning and working-capital management, supporting capacity utilisation and improving business confidence.

Yet analysts caution that currency calm alone will not transform Nigeria’s trade structure. Dr John Isemede, former Director-General of the Nigerian Association of Chambers of Commerce, Industry, Mines and Agriculture (NACCIMA), warned that stability without deeper reforms risks entrenching import dependence.

“Stabilisation of the naira was purely by fiat and will not give us mileage because importation will continue,” Isemede said. “We are not stabilising the economy. Government must focus on building local production to achieve sustainable growth.”

Yusuf agrees that stability must be used strategically. He noted that during the period of sharp depreciation, imports actually fell as costs surged, contributing to balance-of-payments surpluses in parts of last year.

“The moment we had exchange-rate depreciation, imports reduced because the cost of import went up,” he said. “For as long as this stability remains, the level of imports will likely stay where we are.”

He added that fiscal reforms are critical, particularly in reducing petroleum product imports. “There is no reason to be importing so much petroleum products when we have major refining capacity,” Yusuf said. “The fuel import bill is very heavy. That narrative must change.”

Among smaller traders previously squeezed out by dollar shortages, improved FX access through banks is changing behaviour. Aisha Bello, a Lagos-based importer of food ingredients, said stability has revived bulk purchasing.

“We stopped bulk buying when the naira was unstable,” she said. “Now we can buy larger volumes, negotiate better prices with suppliers and spread costs over time.”

Still, the FX crisis has permanently altered how many firms approach imports. Ifeanyi Chinedu , a plastics manufacturer in Anambra State, said the shock forced businesses to confront long-standing vulnerabilities.

“We now source about 30 per cent of our materials locally and invest in recycling,” Chinedu said. “Even if the naira strengthens further, that mindset has changed.”

Trade analysts see this gradual move toward backward integration as one of the most important legacies of the FX turmoil. Tope Olakunle, a trade policy analyst, said stability creates space for strategic thinking.

“The lesson from the crisis is that FX stability must be used to build local alternatives,” Ajayi said. “Otherwise, import pressure will return once demand rises.”

Importers are also becoming more deliberate about managing FX exposure. Musa Sadiq, an agro-commodity importer based in Kano, said firms now spread purchases and avoid concentrating exposure at a single exchange rate.

“We buy in phases and keep part of our working capital in dollars,” he said. “Nobody assumes stability will last forever.”

Banks confirm rising interest in hedging tools. Chiemere Udemba, an economist said importers are increasingly asking about forwards and structured trade finance.

“They want protection, not just access to dollars,” she said.

Policy credibility has also played a role in restoring confidence. Tighter monetary policy, improved FX transparency and the clearing of FX backlogs have strengthened trust.

At the ports, signs of recovery are emerging. Sola Martins, a licensed customs agent at Apapa Port, said cargo volumes have stabilised after months of decline.

“Importers are no longer delaying shipments indefinitely because of FX fear.Clearer pricing helps goods move faster,” he said.

Economists warn that the gains remain vulnerable. Anabel Alade, a development economist, said short-term import growth is likely under current conditions but cautioned against complacency.

“Stability helps trade recover, but it does not remove structural weaknesses,” she said. “Oil revenues, capital inflows and fiscal discipline will determine sustainability.”

For Yusuf, the long-term verdict depends on how the current calm is deployed. “If FX stability supports productivity, exports and local capacity, the benefits will endure. If not, pressure will return,” he said.

For now, Nigeria’s importers are using the naira’s rebound to rebuild confidence, renegotiate supply chains and hedge against future shocks. The currency’s recovery has not solved every problem, but it has restored a tool businesses had almost forgotten how to rely on: certainty.