The rising debt levels of Nigerian states have become a growing concern, presenting significant economic, political, and social implications for the country. With many states increasingly dependent on loans to meet recurrent and capital expenditures, there is a looming risk of unsustainable financial practices that could hinder long-term development and economic stability.

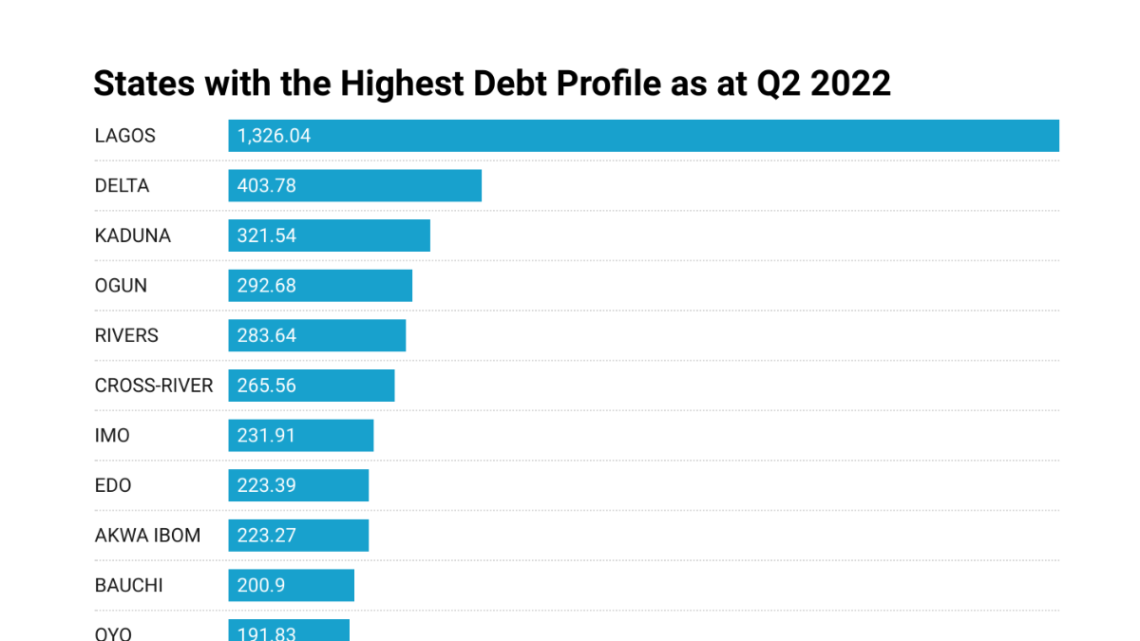

Most states rely heavily on federally allocated revenue, often tied to volatile oil earnings, to fund their budgets. This dependence has led to a mismatch between income and expenditure, compelling states to resort to borrowing to cover deficits. According to data from the Debt Management Office (DMO), subnational debt profiles have climbed steadily, with many states owing both domestic and foreign creditors substantial sums. While debt can be a useful tool for development, its mismanagement poses severe challenges.

One critical implication of rising state debt is the pressure it places on fiscal sustainability. A significant portion of state revenues is now allocated to debt servicing, leaving little room for developmental projects and critical public services. This crowding-out effect stifles infrastructure development, healthcare, education, and other vital sectors, exacerbating poverty and inequality. For instance, many states in Nigeria struggle to pay salaries and pensions, even as they take on more debt to fund short-term expenditures.

Another major concern is the lack of accountability and transparency surrounding how borrowed funds are utilised. Instances of funds being channeled into projects with limited economic returns or outright mismanagement undermine the potential benefits of such borrowing. This breeds distrust among citizens and financial institutions, increasing the cost of future borrowing due to higher risk premiums.

Experts have also pointed out that excessive borrowing without a commensurate increase in internally generated revenue (IGR) diminishes the fiscal autonomy of states. Economist Dr. Tunde Adebayo noted, “Over-reliance on loans creates a dangerous cycle where states become increasingly dependent on external funding sources. This is unsustainable, especially when debt is not tied to productive investments.” Similarly, financial analyst Efe Odigie stressed, “Without clear strategies to grow IGR, many states risk sliding into a debt trap, where repayment obligations outstrip their income.”

The broader national economy is not insulated from the impacts of rising state debts. As subnational entities struggle with fiscal instability, the strain could spill over into the federal government’s finances, which often guarantees external loans for states. This interconnectedness could amplify risks of a sovereign debt crisis if states fail to honour their obligations.

Moreover, the rising debt burden has political ramifications. Citizens increasingly question the rationale behind borrowing and demand greater accountability. The resulting social unrest and dissatisfaction with governance could lead to political instability, further complicating economic recovery efforts.

To address these challenges, Nigerian states must adopt more prudent fiscal practices. Improving internally generated revenue through innovative taxation policies, reducing wasteful spending, and prioritising high-impact investments are critical steps. Collaborative efforts between states and the federal government to enhance economic diversification will also reduce reliance on volatile oil revenue.

Additionally, robust frameworks for debt management and transparency are essential. Citizens deserve to know how borrowed funds are spent, and mechanisms must be in place to ensure loans finance projects with measurable economic benefits. Strengthening the capacity of state governments to plan and execute financially sustainable budgets is also necessary to avoid over-dependence on external loans.

The rising debt profiles of Nigerian states are a wake-up call for urgent reforms. Failure to act decisively risks compromising the economic future of the country and eroding the social contract between governments and their citizens. It is imperative for leaders at all levels to embrace fiscal discipline, transparency, and innovative revenue generation strategies to safeguard the nation’s economic prospects.