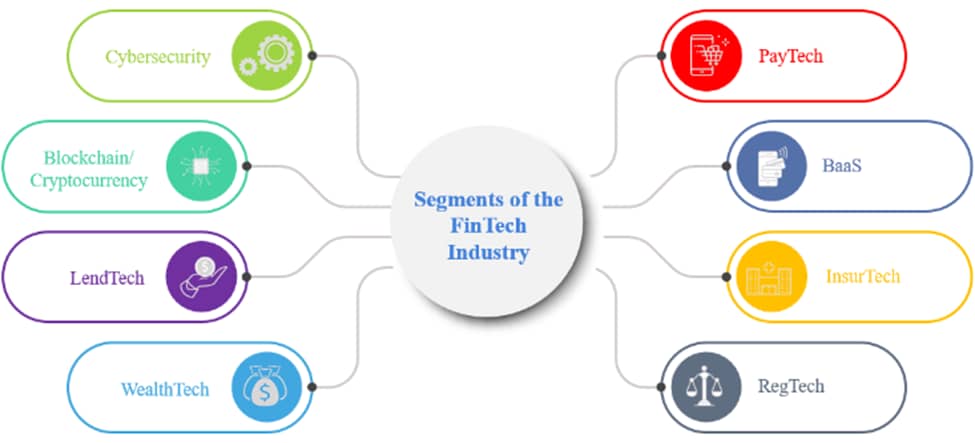

“Financial technologies” emerged as a result of the substantial and quick growth in computing technologies, internet connectivity, and smartphone penetration. These innovations have influenced the traditional banking and financial industry in emerging nations. The banking and financial industry’s use of advanced technological innovations to effectively provide financial services is referred to as financial technologies or FinTech. This encourages and supports the creation of new business models, applications, procedures, and products. FinTech is primarily concerned with digital identity, asset management, payment and remittance systems, financial software, and regulation technology.

Figure 1. Summarizes the segments of the FinTech Industry

Regulatory Bodies For The Fintech Industry

In recent years, the global fintech sector has continued to grow both in investments and revenue. From the research by Statista Market Insights, the revenue of the global fintech industry increased sharply in 2023, the total revenue was estimated at US$79.38 billion, and also predicted to surpass US$141.18 billion in 2028. The industry has assisted individuals, and businesses to better manage their financial operations, processes, and lives.

Despite all these benefits provided by FinTech, the technological growth is associated with severe risks that include; financial data breaches, fraud, malware, social engineering attacks, hacking, crypto-jacking, zero-day attacks, insider threats, man-in-the-middle attacks, identity theft, distributed denial-of-service attacks, supply chain attacks, advanced persistent threat, salami attacks, shoulder-surfing attacks, brute-force attacks, cloud environment security risks, blockchain risks, IoT risks, money laundering, and cryptocurrency-related risks.

These security breaches have resulted in reputational damage, loss of customer trust, password and revenue loss, industrial espionage, data and equity value loss, money laundering, cyberterrorism, higher operational costs, and disruption of FinTech systems and services. Therefore, integrating a security-first tech stack is highly advised for all stages of a fintech company’s technology infrastructure, from development to deployment, in order to guarantee the confidentiality, integrity, availability, authenticity, non-repudiation, accountability, and auditability of users and financial data.

A security-first tech stack is a set of tools and technologies created with the main goals of safeguarding privacy, preventing unwanted access, and protecting data. Security features like encryption, authentication, and ongoing monitoring are given top priority throughout the whole development and operation process. A security-first tech stack is an inventory and roadmap of an organisation’s cybersecurity tools. It covers all the cybersecurity tools an organisation has, their function, and the specific systems they interact with. A security-first strategy for a Fintech business entails creating and implementing technological solutions that are secure by default. It facilitates the reduction of possible weaknesses and lowers the possibility of expensive data breaches or financial fraud.

A security-first technology stack must include intrusion detection and firewalls, cloud security, secure APIs and data sharing, encryption and data protection, authentication and access control, and more. Here is a detailed explanation of what all these entail.

Data Encryption And Protection

Data encryption involves the use of secret codes to make data unreadable without the key. Leveraging data techniques like tokenization, which substitutes random characters for data characters, such as asterisks for digits in credit card numbers, and encryption. So, even if hackers obtain the data, they cannot access it. These keep payment information and other sensitive personal data from unauthorized access. One of the main issues facing the Fintech sector is data protection. The process of shielding private information from harm, loss, or corruption is known as data protection. Access control, data availability, and security are all included in most data protection strategies. Access control is making sure that only those who truly need the data can access it, while data availability is promptly restoring data in the event of loss or damage. Data security is safeguarding data against malicious or unintentional damage.

Authentication And Control Of Access

Unauthorized access is one of the challenges in the industry, and reducing these risks involves multi-factor authentication, biometric verification, and complex password policies. Options like biometrics, one-time codes, and security keys make authentication more rigorous than just usernames and passwords. Effective access control complements these strategies and makes sure that only authorized individuals can access sensitive data. Advanced and robust cybersecurity is non-negotiable for fintech players. Businesses need to be ready to invest heavily in safeguarding their digital environments as the industry changes. This means putting the least privileged principle into practice, which gives each user the bare minimum of access required to fulfil their duties. This method can lessen the possible harm if user credentials are compromised, or insider threats occur.

Secure APIs And Data Sharing

Data sharing via APIs requires a complex implementation process and sound standardization initiatives are essential for its success. This is very important because Fintech companies and other organizations are daily involved in financial data.

Firewalls And Detection Of Intrusion

Generally, firewalls are one effective way to protect your systems from Internet security threats. Financial systems can be shielded from outside threats with a properly configured firewall and a real-time intrusion detection system.

Cybersecurity

Instead of physical servers, use cloud storage like AWS, Google Cloud, or Azure for data-online storage. However certain risks are still involved, one of them being the potential of unwanted access. For this reason, the cloud service provider and the fintech company should share responsibility for the security of these servers. Even so, laws and frameworks pertaining to data storage are available to give fintech businesses direction on where and how to store data.

Regulatory Bodies For The Fintech Industry

The financial sector, including the Fintech industry, has restricted information security policies. This is because financial information is sensitive and private, and the industry is governed by regulations. There are a lot of regulations and frameworks to address the security of information in the Fintech industry. The sensitivity of financial data requires such regulation and compliance in the financial sector.

Also, ISO/IEC 27001 handles specific requirements for information security management systems, ensuring comprehensive data protection. The Payment Card Industry Data Security Standard (PCI DSS) is another regulation standard that handles the information of credit cards, and entities processing payment card transactions.

The General Data Protection Regulation (GDPR) is another European Union regulation on information privacy in the European Union and European Economic Area (EEA). This regulation standard is limited to only members of the European Union and fintech businesses operating there or serving customers are required to comply with the guidelines. However, there are other regional regulations for different countries. Non-compliance can result in substantial fines. For instance, PSD2 is a regulatory body in the E.U. that deals with the security of information.

Compliance poses unique challenges for FinTech startups and established firms. Startups often struggle to allocate resources for implementing regulatory measures, focusing instead on scaling their operations. Conversely, established firms face difficulties in aligning legacy systems with modern compliance standards.

Ultimately, as the Fintech industry continues to evolve, it is important for organisations to ensure robust security measures because of the increase in cyber threats. Measures like data encryption, secure APIs, cybersecurity and the use of firewalls would make a great deal in fighting these issues.

About the Author

Olufemi Titlayo Samuel is an experienced software engineer specializing in building and optimizing fintech applications and mobility technology products. His expertise extends to payment integrations, USSD solutions, ride hailing platforms, digital services, and system integration. When he’s not coding, Olufemi enjoys sharing insights on cutting-edge software development practices.