Stockbrokers under the banner of the Chartered Institute of Stockbrokers (CIS), have called on the federal government to initiate urgent economic reforms aimed at repositioning the Nigerian capital market as a key driver in achieving the country’s $1 trillion economy target.

In the communique after a one day workshop held recently in Abuja with the theme: ‘Capital Formation in Nigeria: Empowering Industry, Institutions, and Markets to Drive a $1 Trillion Economy,’ the Institute affirmed that while Nigeria’s ambition is achievable, it hinges on deliberate, coordinated actions to deepen capital formation across sectors.

The workshop, which brought together, key policymakers, industry leaders, financial experts, and market stakeholders to chart a practical course toward achieving Nigeria’s $1 trillion economic aspiration.

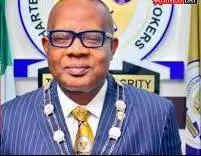

The communique, jointly signed by the chairman and registrar and chief executive officer the Institute, Oluropo Dada and Ayorinde Adeonipekun, respectively, stated that, “the federal government must lead strategic coordination among market stakeholders to harmonise fiscal, trade, and monetary policies aimed at boosting investor confidence and attracting long-term capital.

“Foreign Direct Investment (FDI) inflows remain volatile and below potential due to concerns around currency risk, regulatory unpredictability, and infrastructure gaps. Domestic capital mobilisation through pensions, insurance, and retail investor engagement remains underutilised for industrial financing. A vibrant capital market is essential to support industrialisation, infrastructure development, and inclusive economic growth.

“Integrating Nigeria’s informal sector into the formal economy could unlock significant domestic capital while expanding the tax base and the economy is overly dependent on debt financing, with limited availability of venture capital and private equity to support innovation for startups and other critical sectors. Strong investor appetite is evident in frequent over subscription of government bonds.

“However, Nigeria has yet to fully leverage its diaspora community. Well-structured financial instruments tailored to diaspora savings and remittances could significantly enhance capital inflows and support national development goal,” the communique said.

It stated that, “the federal government should ensure effective co-ordination of market stakeholders to enhance implementation of fiscal, trade, and monetary policies to boost investor confidence and attract long-term capital.

“There is a compelling need to sustain transparent policies for unified FX system that improves liquidity and enhances the ability of foreign investors to repatriate capital seamlessly. Government should prioritise infrastructure development through public-private partnerships (PPPs), Nigeria is in dire need of national savings strategy to mobilise local and savings and channel them into productive sectors, particularly manufacturing and technology. For enhanced efficiency, regulatory approvals should be streamlined to promote innovation such as fintech integration.”

It pointed out that market operators should innovate and scale up diverse financial products to attract different categories of investors, including millennials, Gen Z, Gen Alpha and the likes innovative products in Real Estate Investment Trusts (REITs), venture capital.