In a report released by Yellow Card, Africa’s stablecoin payments infrastructure provider, revealed that stablecoins have become a major force in Sub-Saharan Africa’s cryptocurrency market, accounting for 43 per cent of all crypto transaction volume.

The report stated that “Nigeria stands out as the continent’s largest stablecoin market, with nearly $22 billion in transactions between July 2023 and June 2024, followed by South Africa and other rapidly growing markets such as Kenya and Ghana.”

The report, which is Yellow Card’s third and final report for 2025, underscored the exponential growth of stablecoins globally, from a market cap of $5 billion in 2020 to $230 billion as of May 2025. It highlighted their transformative role and surging adoption in Africa, where they are reshaping finance, trade, and economic participation.

According to the company, while stablecoins are globally recognised for international payments and settlements, their adoption in emerging markets has revealed a deeper story. From cross-border trade to treasury management and inflation hedging, stablecoins are driving innovation and financial inclusion in regions where traditional systems often fail.

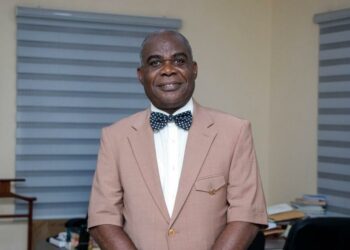

The vice president of Global Operations and managing director of Yellow Card Nigeria, Lasbery Oludimu, emphasised the importance of the report, saying, “this report highlights the significant role of stablecoins in emerging markets. It demonstrates how stablecoins are crucial for financial inclusion and economic empowerment, especially where traditional banking is unreliable. From facilitating cross-border trade to aiding treasury management, stablecoins are now a fundamental tool for financial stability and efficiency.”

The report noted that “this surge in adoption comes against a backdrop of major global trade disruptions. In August 2025, the United States introduced sweeping tariffs of 10 per cent to 30 per cent on exports from 47 African nations.

“While the policy rattled traditional markets, in Africa, it is accelerating the shift toward dollar-backed digital assets like USDC and USDT as businesses and individuals sought to bypass dollar scarcity, protect purchasing power, and assert monetary sovereignty. The passing of the GENIUS Act in the United States earlier this year – further legitimising stablecoins globally and setting clear regulatory frameworks – the U.S. has indirectly spurred confidence in African markets to expand adoption.”

The report also examined how African fintechs are driving stablecoin-powered solutions that are faster, cheaper, and more inclusive than legacy banking systems. From Lagos to Nairobi, startups are embedding stablecoins into mobile money platforms, cross-border trade, payroll, and treasury management, creating a scalable model for other emerging economies.

Nigeria Country manager, Somtochukwu Nsofor said, “stablecoins in Nigeria show promise in oil and gas, manufacturing, and banking by enabling fast, low-cost cross-border payments and mitigating FX risks. But issues like dollarization concerns, rural digital literacy, and infrastructure gaps still hinder broader growth.”

With its bold entrance into emerging markets and operating in over 20 African countries, Yellow Card continues to be the continent’s leading stablecoin payments infrastructure provider.