Nigeria’s housing deficit has been a perennial challenge, with millions of citizens struggling to access affordable and decent housing. The deficit, estimated to be over 17 million units, is not only a humanitarian concern but also a significant economic burden. As the country’s population continues to grow, it is imperative that to adopt a multi-faceted approach to address this pressing issue.

One of the primary obstacles to addressing Nigeria’s housing deficit is the lack of funding for affordable housing projects. That spells the need for the government to prioritise the allocation of resources to support initiatives that promote affordable housing. This can be achieved through partnerships with private sector investors, international organisations, and non-governmental organisations.

Nigeria’s regulatory environment is often cited as a major obstacle to housing development. Baring that albatross, it is imperative that the government simplifies and streamlines regulatory frameworks to encourage investment in the housing sector. This includes reducing bureaucratic hurdles, clarifying land ownership laws, and providing incentives for developers who focus on affordable housing.

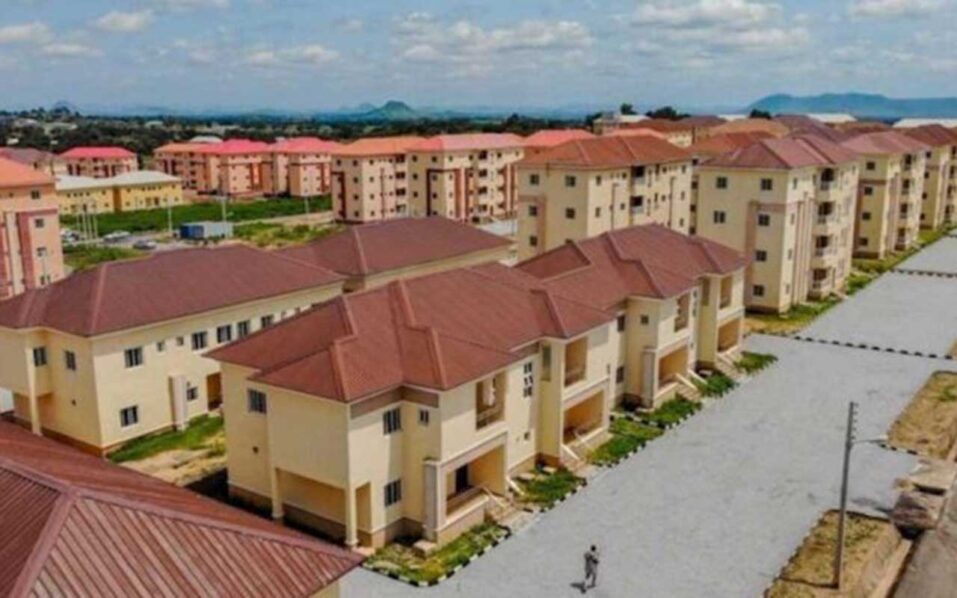

Furthermore, Public-Private Partnerships (PPPs) offer a viable solution to Nigeria’s housing deficit. By leveraging private sector expertise and funding, the government can accelerate the delivery of affordable housing units. PPPs can also facilitate the development of supporting infrastructure, such as roads, water supply, and electricity.

Innovative housing solutions, such as prefabricated housing, container homes, and eco-friendly buildings, can help bridge the housing gap. The government could incentivise developers to adopt these innovative solutions, which are often faster, cheaper, and more sustainable than traditional building methods.

Land ownership and titling issues are significant challenges in Nigeria’s housing sector. The government must prioritise land reform, ensuring that land ownership is secure, transparent, and accessible to all. This includes implementing a robust land titling system, reducing bureaucratic hurdles, and promoting community-led land development initiatives.

Access to affordable housing finance is also a critical component of addressing Nigeria’s housing deficit. The government should establish specialised housing finance institutions, offer subsidised interest rates, and provide guarantees for low-income housing loans. This will enable low-income earners to access affordable housing, reducing the financial burden on households.

Addressing Nigeria’s housing deficit requires a comprehensive and multi-faceted approach. By increasing funding for affordable housing, streamlining regulatory frameworks, promoting public-private partnerships, encouraging innovative housing solutions, addressing land ownership and titling issues, and supporting low-income housing finance, Nigeria can make significant progress in bridging the housing gap. It is time for policymakers, developers, and stakeholders to work together to ensure that every Nigerian has access to affordable, decent, and secure housing.