Wema Bank Plc has posted its financials for the half-year ended June 30, 2025, recording a 231 per cent rise in Profit Before Tax (PBT) to N101.2 billion, up from N30.55 billion reported in the corresponding period of 2024.

According to the result released to investors on the Nigerian Exchange, the bank’s gross earnings rose sharply by 70 per cent to N303.20 billion in the first six months of 2025, compared to N178.63 billion in the same period of 2024. Interest Income also climbed by 65 per cent year-on-year to N240.12 billion, while Non-Interest Income surged by 91 per cent to N63.08 billion.

Wema Bank’s total assets grew by 11 per cent from N3.585 trillion in H1 2024 to N3.963 trillion as of June 30, 2025. The bank’s deposit base also inched up by 3 per cent to N2.60 trillion from N2.523 trillion in full-year 2024, while Loans and Advances expanded by 19 per cent to N1.426 trillion from N1.201 trillion during the same period.

The bank maintained a healthy Non-Performing Loan (NPL) ratio of 3.17 per cent in H1 2025, reflecting prudent risk management and a continued emphasis on asset quality.

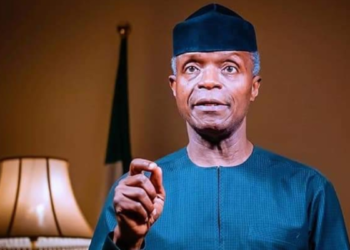

Commenting on the financial performance, the managing director and chief executive of Wema Bank, Mr. Moruf Oseni, expressed satisfaction with the Bank’s trajectory, stating that the results demonstrate Wema Bank’s enduring commitment to value creation and operational excellence.

“For 80 years, Wema Bank has redefined the impossible, consistently breaking new ground and delivering positive impact. Three years ago, we grew our PBT from N14.75 billion in 2022 to N43.59 billion in 2023. In 2024, we hit N102 billion. Now, just halfway into 2025, we have already achieved over 99 per cent of our 2024 full-year PBT. For us, this is just the beginning,” Oseni stated.

He continued: “We remain committed to surpassing expectations and redefining limitations. Wema Bank is the bank that works for all, and we will continue to pull all stops in delivering optimum value to every stakeholder—from our shareholders to customers, employees, partners, regulators, and all who have contributed to our 80-year journey.”

Return on Average Equity (ROAE) rose by 60.40 per cent, Return on Average Assets (ROAA) grew by 4.64 per cent, Capital Adequacy Ratio (CAR) improved by 13.68 per cent, and the Cost-to-Income Ratio recorded a notable growth of 47.55 per cent.