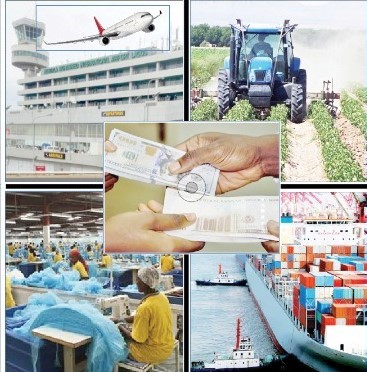

There is hardly any sector of the Nigerian economy that is not being adversely impacted by the scarcity of foreign exchange. This is to be expected considering the fact that most of the production inputs that keep the economy going, as well as consumer goods are imported. With the ever-widening gap in the value of the local currency in relation to international currencies, notably the dollar, the cost of virtually everything in the economy is affected.

Moreover, the effects of inflation in countries Nigeria imports from are invariably brought to Nigeria in the form of imported inflation.

Why Forex Crisis Will Linger

Over the years, foreign exchange crisis in Nigeria has remained a nightmare that won’t go away. The Central Bank of Nigeria (CBN) has introduced a lot of measures with interventions in different sectors to prop up the naira, yet, the local currency has been on a free fall.

Pundits told NATIONAL ECONOMY that the exchange rate pressures in the Nigerian foreign exchange market will continue except the managers of the economy return the nation to a vibrant producer of agriculture products and industrialization.

According to Charles Ojo, Nigeria’s woes have been compounded with the legacy of oil dependence. Relying on oil has done little to stimulate growth in the rest of the economy as the manufacturing sector’s contribution to gross domestic product has stagnated at below 10 per cent for decades. The country has achieved neither an agricultural (green) nor an industrial revolution.

‘‘Oil dependence sets in motion a strong exclusionary effect on other sectors leading to the underdevelopment of manufacturing capacity for industrial exports and export of processed agricultural goods. It has resulted in severe perennial fiscal contraction and other economic challenges, including unemployment, inflation and payments imbalance manifesting in foreign exchange shortages,’’ he said.

According to Prof Oyelaran-Oyeyinka, Nigeria will only strengthen its currency, the naira, by diversifying its economy away from oil.

‘‘Nigeria shipped $33.5 billion worth of goods in 2020. The biggest export is crude oil, a commodity that represents three-quarters (75.4%) of its total exported goods by value. With a population of 206 million people, the total export value translates to roughly $160 for every person. Compare a country like Malaysia. In 1990, Malaysia’s export was $32.8 billion. Nigeria is at where Malaysia’s export capability was 30 years ago. That country with a population of 33 million people, exported goods worth $234 billion in 2020, which translates to roughly $7,100 for every resident. In other words, Malaysia progressed; it did so through strong Vertical Diversification from its modest agricultural base (rubber and oil palm) by investing explicitly in high tech sectors capabilities, especially electronics. It did not neglect its agriculture but rather through horizontal diversification, industrialised its agricultural sector,” Oyeyinka said.

Implications On Sectors

Reacting to the impact of the forex crisis in Nigeria, the former director general of Lagos Chamber of Commerce and Industry (LCCI) and CEO of Centre for the Promotion of Private Enterprise (CPPE), Dr. Muda Yusuf said many businesses have suffered serious dislocations as a consequence of foreign exchange liquidity challenges, volatility and the depreciation of the currency.

According to him, these have severely affected businesses across all sectors of the economy. Costs of operation and production have gone up from between 30-100 per cent as a result of the exchange rate crisis.

“Outputs have declined significantly in many industries because of the challenges of accessing raw materials due to the scarcity of foreign exchange. Many players in the economy now resort to the patronage of the parallel market at very prohibitive cost, as very little access exists on the official window.”

Yusuf explained that the implications of the foreign exchange crisis for the manufacturers led to high cost of production because of the high import dependence of our manufacturing sector for imported raw materials; high operating costs across businesses in practically all sectors of the economy; low sales and turnover because of the increase in price and effect on demand; erosion of profit margins because not all the additional cost can be passed on consumers; increased business continuity risk for some segments of manufacturing; and the severity of impact varies across sectors depending on the degree of business exposure to imports.

President, Manufacturers Association of Nigeria (MAN), Mansur Ahmed, lamented lack of foreign exchange, saying most of the raw materials that manufacturers use were imported.

“We cannot source the foreign exchange to bring in the raw materials, because the dollars have gone too high. How would you be able to produce at that exchange rate and still be able to sell? There will be no market. We are appealing to the government and its agencies to take a second look at the situation.”

He noted that the situation is bad as a lot of manufacturers, especially those depending on foreign imports may end up winding down, saying some have shut down operations especially due to the inaccessibility of forex for raw materials importation and more are shutting down.

He noted that some manufacturers are resorting to the black market which is more expensive.

The naira has fallen against US dollars steadily from 2015 till date. The exchange rate gap at the parallel market has become wide compared to the official rate with the Central Bank of Nigeria (CBN). However, most importers in Nigeria cannot access dollars at the official rate, thereby making it hard for importers of goods and raw materials to ship cargoes to Nigeria.

However, stakeholders have said that cargo importation into Nigerian ports has reduced drastically to about 50 per cent, even as importers and Customs-licensed agents attributed the reduction to high exchange rate.

As the high exchange rate hit importers very hard, investigations also revealed that most factories are producing at a very low capacity due to inability to import raw materials.

Speaking, Chairman of Tin Can Port Chapter, Association of Nigerian Licensed Customs Agents (ANLCA), Alhaji Muhammed Mojeed, said that high exchange rate and other challenges are responsible for the shortage of cargo at the port.

According to him, containers exiting the port have reduced drastically from 400 containers per day, to as low as 100 containers per day, adding that reduction can be attributed to the present high exchange rate and lack of access to foreign exchange.

“The volume of cargo coming into Nigeria has reduced; if you go into some terminals now, you would find out that, a terminal that usually drops 400 containers for examination per day, hardly would drop 100 containers now because of the exchange rate.

“Right now, the rate of cargo importation has dropped; there is no way importers even get money to clear their cargoes. The dollar rate is too high and this has made it difficult for importers to carry out importation. Some factories are now producing at 50 per cent capacity because of their lack of access to raw materials,” he said.

Similarly, the continuous decline in the value of naira has raised serious concerns among stakeholders as the agricultural trade deficit continues to widen amid federal government efforts for food self-sufficiency in the sector.

At the parallel market for instance, the naira currently fluctuates between N600-N710 per dollar even in the face of a shortfall in foreign exchange supply as demand increases.

Many experts believe that the current rise in exchange rates is connected to high demand for dollars ahead of the 2023 general elections. Nigeria’s inflation is majorly derived by three main factors such as too much money in circulation, the rising cost of inputs, and too much demand relative to supply.

On the impact of forex scarcity on the aviation industry, chief executive officer of an aviation company, Segun Adewale, said, “We have lost so many airlines and jobs are being lost in the aviation sector and at airports generally.

“The development is inimical to our economic wellbeing as a nation; from the spiritual angle of thought, it is wrong to muzzle the ox that treads the corn,” he stated.

He also decried that forex, which had been blocked in the industry, had already led to reduction of air connectivity and restriction of flights.

He stated that it was disheartening that the same forex being denied the airlines was being released to import non-essential products such as champagne and toothpicks.

“If foreign airlines suspend flight operations, businesses will be shifted to neighbouring countries like Ghana and Benin Republic.

“The issue is so difficult for the operators, who now borrow forex from their home offices to fuel their airplanes.

“With the increase in dollar rate leading to rise in flight ticket prices, especially en-route America and Dubai, which is now over a million naira, the environment is getting hostile for businesses to thrive,’’ he stated.

It would be recalled that one of the airlines, Emirates Airlines had announced the suspension of its flight operations in Nigeria from Sept. 1, over its inability to repatriate its funds from the country.

Experts’ Views On Solution

Experts said Nigeria needs to undertake a comprehensive overhaul of its economic and governance system to stem the tide of exchange rate and price volatility. According to Dr. Biodun Adedipe, chief consultant at B. Adedipe Associates, a firm of management and financial consultancy, ‘‘The government should shift focus to industrial production; focus on industrialization; revisit and update the national industrial revolution plan; select sectors of importance for import substitution; identify sectors and products for export-led growth; provide relevant incentives, including tariff restructuring that focus on regional competitiveness; commit to ‘make-in-Nigeria’ and ‘made-in-Nigeria’; target infrastructure development at industrial clusters.

The overbearing impact of the oil sector on the economy has exposed the country to external shocks whenever there were crude oil price changes. In order to insulate the Nigerian economy from the shocks and FX shortages there is the need to develop new strategies aimed at earning more stable and sustainable inflows of FX, through diversification of the non-oil exports sector.’’