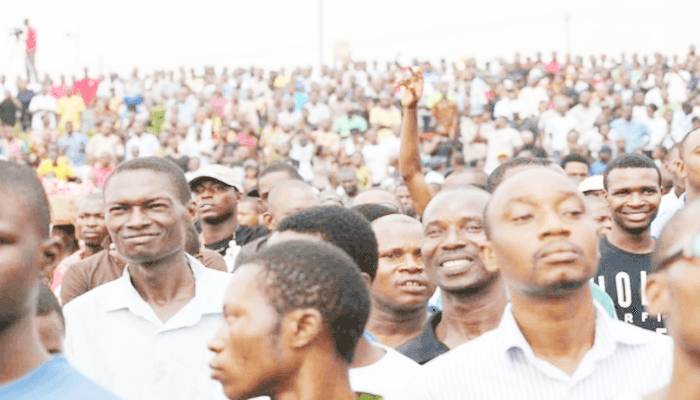

Nigeria’s growing youth population and decreasing mortality rate will either inflict economic misery or economic dividend over the coming decades, depending on how the three tiers of government take advantage of the country’s youth bulge, NATIONAL ECONOMY reckons.

The youth bulge is a common phenomenon in many developing countries, and in particular, in the least developed countries. It is often due to a stage of development where a country achieves success in reducing infant mortality but mothers still have a high fertility rate. The result is that a large share of the population is children and young adults, and today’s children are tomorrow’s young adults, making it a recurring decimal.

Although Nigeria’s gross domestic product (GDP) is forecast to grow by 3.1 per cent in 2023, depending on the author of the forecast, (IMF, World Bank and the federal government), population growth rate has averaged 2.6 per cent over the past eight years.

The African Youth Charter recognises youth as people between 15 and 35. By that definition, more than 65 per cent of Nigeria’s population is youth, according to the International Monetary Fund.

The demographic puts Nigeria on an economic fulcrum, doom or boom, depending on the governments’ policies and successes in accommodating her youth population over the coming decades.

The IMF said in a country with a youth bulge, as the young adults enter the working age, the country’s dependency ratio, that is the ratio of the non-working age population to the working age population will decline. If the increase in the number of working age individuals can be fully employed in productive activities, other things being equal, the level of average income per capita will increase as a result. The youth bulge will become a demographic and economic dividend.

However, if a large cohort of young people cannot find employment and earn satisfactory income, the youth bulge will become a demographic and economic bomb, because a large mass of frustrated youth is likely to become a potential source of social and political instability. Therefore, one basic measure of a country’s success in turning the youth bulge into a demographic dividend is the youth high employment rate.

Nigeria’s current youth unemployment rate is 53.4 per cent, one of the highest in the world, even by developing countries’ standards.

In an interview with Professor Adekunle Gbangbose of Usman Dan Fodio University, the federal government can make a demographic dividend or misery of her fledgling youth population depending on the kind and quality of education it can afford them.

Drawing from the experience of East Asian economies, they have been able to turn the youth bulge into a demographic dividend. The Republic of Korea has, over the past fifty years, decreased the dependency ratio substantially in Korea. In addition to dramatic GDP growth and rapid increases in average wages, youth unemployment has been below 12 per cent and often in the single digits in recent years. The same is true for China. Its dependency ratio followed a similar pattern to Korea’s. Since initiating economic reforms in late 1970, China has been able to generate millions of new jobs while also relocating young workers from lower-productivity agricultural activities to higher-productivity manufacturing, all without experiencing high unemployment among the youthful labor force. In recent decades, countries in North Africa have also experienced dramatic declines in the dependency ratio.

The World Bank posits that the conventional approach for dealing with youth bulge is to make young people job ready. The idea is that young people’s skills, or more broadly, human capital needs to be increased to enhance their productivity in the labor market.

A successful development strategy that will facilitate structural change and create job opportunities for youth can be based upon the principles outlined in the New Structural Economics (NSE) and its policy implementation via the Growth Identification and Facilitation Framework. The NSE highlights that a country’s economic structure is endogenous to its endowment structure; however, the government needs to play a facilitating role in the process of structural change and this role needs to be structured according to clearly defined principles.

As outlined by the IMF, first, for the Nigerian economy to be competitive in both the domestic and international markets, it should follow its comparative advantage, as determined by its endowment structure. In the early stage of development, sectors that the economy has a comparative advantage will be labor or resource intensive. Examples include light manufacturing, smallholder agriculture, fishing, and mining. Only a few activities like mining are likely to be capital-intensive in this early stage.

In the later stages of development, the competitive sector will become increasingly capital-intensive, as capital accumulates thus changing the country’s endowment structure. In the industrial upgrading towards more capital-intensive production, infrastructure needs to be improved simultaneously to reduce the firms’ transaction costs, with a clear role for the government to play in this regard.