Research has shown that cybercriminals have an association. They are interconnected. They are sophisticated. They are unrelenting. That is why the card associations, too, are digging into their arsenal. Soon, you will experience a new high in how you make financial transactions.

Before then, let us retrace the legacy methods. The bank will request something you know – login information or secret question answers – to authenticate your transaction. At times, it can be something you have – a mobile phone or a computer – before you can complete a transaction. Payment authentication is a way of confirming your card number and personal data. You either need this to make payments online or at the ATM. But, you know, thieves can steal these personal assets. You need something precious. You need something that thieves cannot steal.

On The One Hand

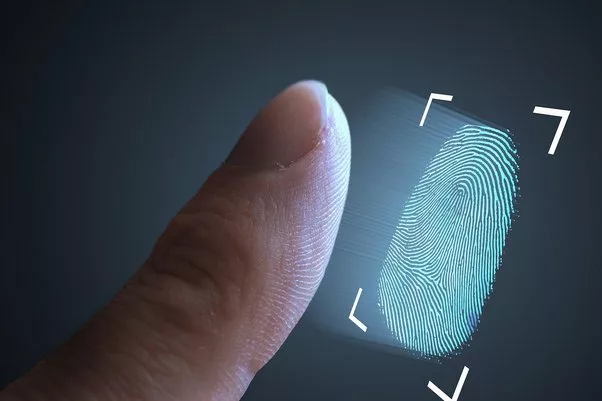

To protect yourself, in the future, you would need something Made by God. Something thieves cannot steal. You would need your fingerprint. Your fingerprint would change the authentication process. Forever. That is because it is safe. According to www.outseer.com when it comes to online and mobile commerce, the need for transaction authentication has never been greater. Global spending on e-commerce reached $4.2 trillion in 2020, a growth of almost 28 per cent. However, losses from illegal purchases using stolen credit card numbers are growing nearly as fast.

In Biometrics: The Future of Payment Authentication, Infosecurity-magazine.com, shared that biometric payment cards are in trial across some banks in Europe. The card has one single benefit. Security. It has no transaction limit. You can begin using the card by recording your biometric data to a sensor device in the bank.

Writing in electronicpaymentsinternational.com Robert Puskaric, CEO of a biometric solutions provider, Zwipe, informed that biometric payment cards would demonstrate the fastest growth in the adoption of new technology in the payments industry.

He said the industry has issued three billion payment cards annually. But this was not achieved overnight. It took a long time. For instance, issuing one billion cards annually, it took 18 years. On the other side, contactless took eight years to achieve the same volume in 2007.

The super next move is to integrate biometric authentication into payment cards. The card would give users one thing. Security. The card would be an efficient-safe-simple-to-use payment solution. Puskaric said with adoption already rising, 2023 might be the hurray year!

On The Other Hand

Access Bank has launched facial biometrics to verify customers’ identities and authentications. Both for in-person transactions and online banking. The users need no passwords. Standard Bank of South Africa has followed suit. It has added facial recognition to its mobile app. It collaborated iiDentifii.

The biometric solution is fast. It’s seamless. It’s convenient. It needs no card. It eases payments for internet-shy individuals. It allows individuals to authenticate themselves conveniently. No PIN. No needle. No signature. In most markets, a user needs to undergo authentication before diving into this endless ocean of convenience.

Your fingerprint is enough to authenticate your transactions. Due to this, there is no cap on your transaction. All you get is the convenience of contactless payments. Biometrics is a staple of everyday life for users.

Puskaric said the ecosystem is experiencing the success of mobile technologies in the card ecosystem. In five years, research showed that millions of biometric payment cards would be produced. As such, issuers must be at the forefront of this revolution. Or lose their top-of-wallet status. Mastercard. Visa. Plus, other pioneers.

In The Short Term

What will the cybercriminals do next?

They would become dinosaurs.

Or dissolve the association.