Nigeria, considered the powerhouse of Africa, finds itself grappling with a mounting debt crisis that demands immediate attention and strategic solutions. The country’s debt burden has escalated to alarming levels, posing significant challenges to its economic stability and long-term development prospects. As Nigeria stands at a crossroads, it is imperative for policymakers and stakeholders to take prudent measures to address the crisis and pave the way for sustainable growth.

Nigeria’s debt crisis is multi-faceted, rooted in a combination of internal and external factors. Internally, years of mismanagement, corruption, and a heavy reliance on oil revenue have exacerbated the country’s fiscal vulnerabilities. External factors, including global economic fluctuations, volatile oil prices, and the COVID-19 pandemic, have further deepened Nigeria’s debt woes.

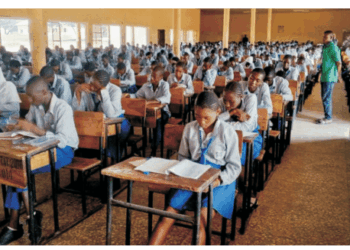

At present, Nigeria’s debt burden stands at an alarming level, with both external and domestic debts on the rise. The country’s external debt alone has surpassed $30 billion, and its debt servicing costs have become increasingly burdensome. Such a precarious situation puts a strain on the nation’s resources, diverting much-needed funds away from crucial sectors such as healthcare, education, and infrastructure development.

The repercussions of Nigeria’s escalating debt crisis are far-reaching. Firstly, the country’s creditworthiness and investor confidence are compromised, leading to higher borrowing costs and limited access to capital for crucial development projects. Secondly, the debt overhang stifles private sector growth, inhibiting job creation and economic diversification. Thirdly, the heavy debt burden crowds out public spending, hindering investment in vital social services and human capital development. Lastly, the debt crisis erodes public trust and exacerbates socioeconomic inequalities, which can lead to potential social unrest.

To address Nigeria’s debt crisis effectively, a multi-pronged approach is necessary, combining fiscal prudence, structural reforms, and transparent governance.

Strengthen Fiscal Discipline: The Nigerian government must enforce strict fiscal discipline by curbing wasteful spending, eliminating corruption, and enhancing budget transparency. This includes rationalizing subsidies, improving tax administration, and implementing effective public financial management systems.

Economic Diversification: Overdependence on oil revenue has been a major driver of Nigeria’s debt crisis. It is crucial to diversify the economy by promoting non-oil sectors such as agriculture, manufacturing, and services. This entails creating an enabling business environment, providing incentives for private sector investment, and fostering innovation and entrepreneurship.

Debt Restructuring and Management: Nigeria should explore options for debt restructuring, renegotiation, and debt-for-development swaps. Collaborating with international financial institutions and bilateral partners to secure favorable terms and longer repayment periods can alleviate immediate debt servicing pressures.

Transparent Governance and Anti-Corruption Measures: Strengthening institutional frameworks, enhancing transparency, and intensifying the fight against corruption are vital. This will boost investor confidence, improve governance practices, and ensure that borrowed funds are utilized efficiently and effectively.

Investments in Human Capital: Prioritising investments in education, healthcare, and skills development is essential for long-term sustainable growth. A well-educated and healthy population can drive innovation, productivity, and economic diversification, reducing reliance on debt to fund social services.

Nigeria’s debt crisis presents a formidable challenge that demands immediate action and long-term strategic planning. It requires a collective effort from the government, civil society, and the private sector to implement prudent measures that address the root causes of the crisis. By strengthening fiscal discipline, diversifying the economy, promoting transparent governance, and investing in human capital, Nigeria can overcome its debt burden and chart a path toward sustainable development.